Rethinking real estate ownership.

Permissionless, compliant, and first-of-its-kind. Powered by the blockchain.

Fractional investments democratize access to real estate ownership and distribute and minimize the risks and labor involved in owning property.

We can help you create a marketplace that provides investors around the globe with a simple, intelligent, fully compliant, and user-friendly method to buy and sell fractional, tokenized shares of real estate properties and diversify their portfolios by investing in multiple properties with relatively small amounts of capital. Tokenized shares also reduce the barriers to entry and the transaction costs associated with traditional real estate investing.

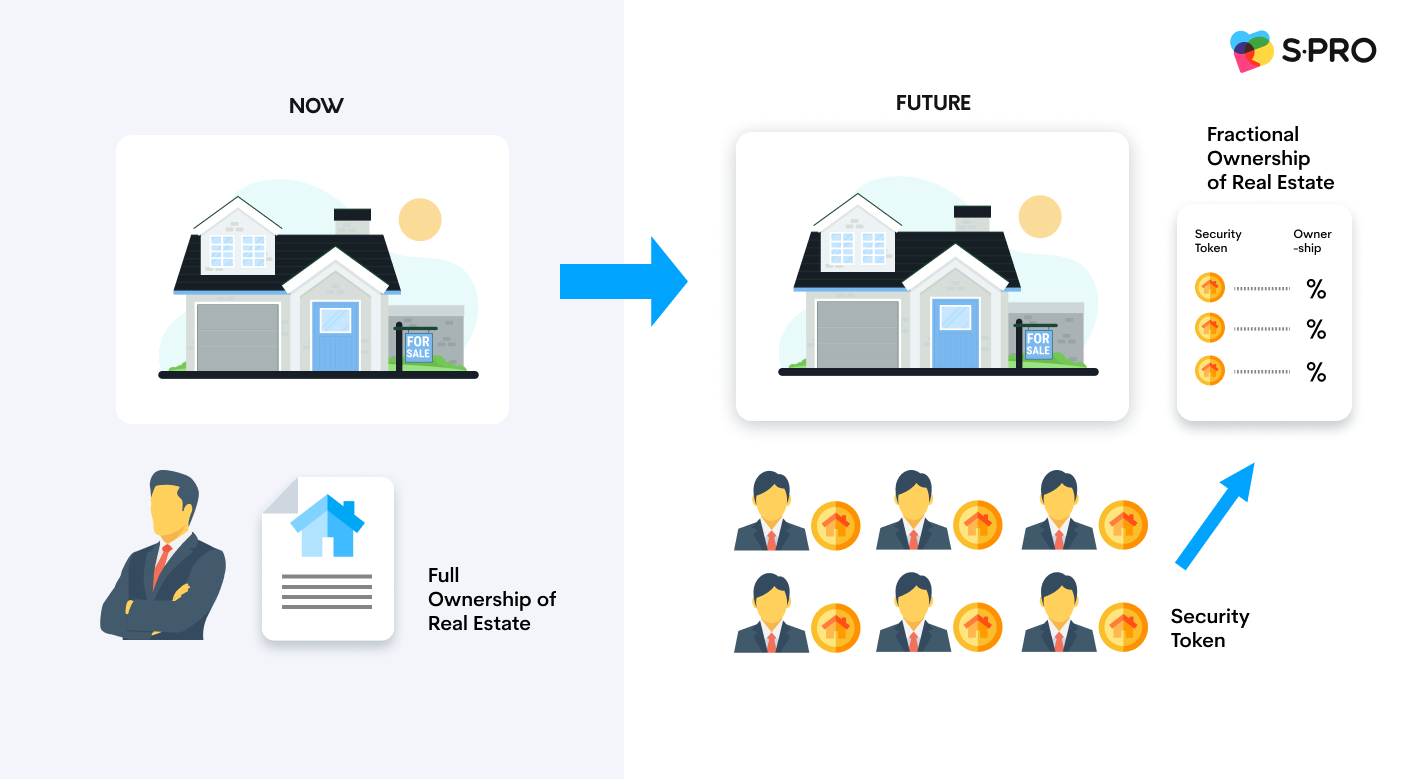

How Real Estate Tokenization Works

With a real estate investing marketplace, property owners can convert a property into shares (tokens) — that is, tokenize the property. Users of such a marketplace can purchase cryptocurrency tokens that are equivalent, for example, to one square meter of a given property. Legally, the property does not belong to token holders, but the tokens do. In exchange for holding these tokens, investors receive monthly rental income. At any time, token holders can exchange their tokens for money, as the platform itself buys back tokens.

Shares in houses, apartments, or commercial real estate can be converted into tokens designating a token holder’s share of ownership in a given real estate object. This is beneficial for both property owners and investors, who don’t need to pay the full amount for a real estate object in order to profit from its rental.

In simple words, real estate tokenization is the process of converting large real estate assets into smaller portions called digital tokens. Each token is a share of real estate property ownership.

Tokenized real estate investment opens many opportunities for investors, as they no longer need to save a large amount of funds to buy a property. Now, they can invest in high-value properties by buying a share.

Moreover, investors are not limited in the number of shares they can buy. For example, a $600,000 rental property is tokenized into 10,000 shares that cost $60 each. You buy 100 shares for $6,000 and own 1% of the property.

With the help of smart contracts, anyone can purchase and claim real estate assets without any intermediary or paperwork. Smart contracts automatically give the buyer ownership rights and distribute rental income.

Compared to the standard process of real estate selling, which can take months or even years to complete, tokenized real estate can be easily traded. Also, investors from all over the world have access to different real estate markets, which opens many new opportunities and increases competition.

The main technology that stands behind real estate tokenization is blockchain technology and smart contracts. Here is how it works:

Blockchain technology is a pillar and a digital ledger of real estate tokenization. Blockchain platforms tokenize real estate assets by turning them into digital assets.

Smart contracts act like self-executed digital contracts that store all the information about real estate assets, their price, distribution rules, and ownership rights

Now let’s process into how real estate tokenization actually works:

Choosing a property

First, property owners need to evaluate their property based on its size, location, and other factors. It’s also crucial to check the legal and financial aspects of the real estate and ensure that it meets local and international regulations.

Creating legal documents

After the property is selected, it’s necessary to hire a professional appraiser who will create legal contracts that regulate the rights of token owners, explain ownership and token transfer rules, and determine the number of tokens that represent the property.

Creating digital tokens

After the contracts and legal frameworks are ready, it’s time to create digital tokens. Tokens are created on the blockchain platform with the help of smart contracts. Each token represents a certain percentage of real estate ownership.

Onboarding investors

All investors interested in real estate tokenization should undergo the verification process to check their compliance with regulations (such as AML and Know Your Customer). At the same time, it’s important to ensure that the onboarding process is not too overwhelming so investors can easily and safely register, buy, and store their tokens.

Selling the token

The tokens are sold via a tokenization platform that regulates the process’s transparency and compliance with laws and regulations. If you are an investor who owns a share of tokenized property, you don’t need to go through a time-consuming buying-and-selling process. You can place them on a secondary market and buy/sell your ownership shares without waiting until the property is sold.

How Can Real Estate be Tokenized

Tokenization of real estate ownership means converting real estate assets into digital tokens on a blockchain network. Tokenized real estate allows for fractional ownership, increased liquidity, and lower transaction costs.

There are several platforms that offer tokenized real estate investments:

- RealT is a blockchain-based platform that offers fractional ownership of properties located in Detroit, Michigan.

- Harbor is a digital platform that offers a range of tokenized real estate investment opportunities, including commercial and residential properties.

- Propellr is a blockchain-based platform that offers fractional ownership in a range of real estate investments, including residential, commercial, and industrial properties.

- Brickblock is a blockchain-based platform that offers tokenized real estate investments in a range of countries including the United States, Germany, and the United Kingdom.

- Blockimmo is a blockchain-based platform that offers tokenized real estate investments in Switzerland.

Overall, investing with such a platform means low-maintenance property ownership, access to property-related cash flows (such as rent), and frictionless token exchanges in the marketplace. This is beneficial for investors, as purchasing a property usually requires a lot of money.

Key features that could be included in a blockchain-based real estate marketplace

- Frictionless transactions: blockchain technology can enable quick and secure transactions while reducing the need for intermediaries such as banks, brokers, and lawyers.

- Access to data: investors can access data and analytics about real estate properties, including market trends, property performance, and investment opportunities.

- Risk management tools: risk management tools for portfolio diversification, due diligence, and insurance can help investors manage their real estate investments.

- Community features: forums, blogs, and social media integrations can foster engagement and provide a platform for investors to connect and share information.

Real Estate Tokenization: Navigating the Legal and Regulatory Landscape

Real estate tokenization is on the rise. According to the Boston Consulting Group report, the real estate tokenization market size will reach $16 trillion by 2030. However, this niche still has a lot of risks, obligations, and prejudices. Before investing in real estate tokens, we recommend researching all the risks and pitfalls you may face. Let’s review the most common ones.

Lack of clear regulations and compliance standards

Here’s the quote from Founder of Zircon Tech, Andres Zunino:

“One of the primary concerns is the lack of a consistent regulatory framework that governs the crypto market. Different jurisdictions have varying rules and regulations surrounding digital assets, leading to confusion and uncertainty for investors and issuers. Moreover, the absence of a centralized reporting system for tokenized real estate transactions can hinder transparency and make it difficult for regulators to monitor and enforce compliance.”

For now, there is no defined regulatory framework for real estate tokens. That’s why it’s not clear what laws, requirements, and licensing to follow in various jurisdictions. Most of the requirements are quite ambiguous, so it’s easy to fall into the trap of penalties.

For example, there is no classification of token types, so it’s hard to define whether some types of tokens belong to cryptocurrencies, securities, or entirely new classifications. That’s why if some real estate tokens fall into the category of securities in some regulations, issuers should adhere to certain rules. However, as there are no strict definitions of token types for now, most issuers do not follow these rules or do it incorrectly. This often leads to problems in real estate property lecensing and tax obligations.

Security issues

Smart contracts are a relatively new technology, which is why there are still many concerns about their security. They store information such as token issuance, ownership transfer, etc., which makes them complex software. Any vulnerabilities in the smart contract code can lead to hacks. That’s why it’s essential to test and audit smart contracts before they go live and run regular diagnostics to prevent data leakage.

Also, like in any other technology, technical glitches, network outages, or infrastructure errors may prevent investors from accessing or trading their tokens. Moreover, there are no regulatory bodies currently governing tokenized real estate investment or protecting investors from data breaches by token issuers. This industry is entirely self-regulated. Because of the complexity of real estate tokenization, retail investors often lack the knowledge to evaluate risks and avoid them in the future.

Market penetration

Real estate tokenization is a new topic, and that’s why traditional investors are not ready to risk it and embrace it. To understand the concept of real estate tokens, you need to have knowledge of blockchain, which is why the entrance threshold of real estate tokenization is quite high.

Case Studies of Real Estate Tokenization

No, let’s review a case study of real-estate tokenization.

HM Land Registry – a UK department that records 25 million ownership titles on lands and properties with a total value of $8.7 trillion, has decided to partner with Consensys Codefi – a leading blockchain and web3 software company. Their goal was to implement blockchain and smart contract technology to transform the real state market and make it more open.

As a result, they have created a digital token that represents ownership of a specific property. Now, property owners can log in via a digital wallet and create security tokens linked to their Title Token. After defining the rules of these tokens, owners can launch, manage, trade, and organize their tokens.

Another case comes from Finexity, a German platform that specializes in digital securities. Using blockchain, crypto, and smart contracts, Finexity has offered investors the opportunity to participate in club deals to help real estate developers raise funds for their projects. Here’s how it works:

- Finexity creates a special-purpose vehicle (SPV) for each project

- This vehicle acquires physical assets, and investors can access these assets via tokenized subordinated debt issued by the SPV. These assets are tokenized, which increases liquidity and makes the investment process more transparent and quick.

As a result, these companies got the following benefits from tokenizing their assets:

- Secure and efficient transactions

- No paperwork and middleman

- Ability to distribute the assets globally