Financial companies are currently under the crush of digital disruption, trying to meet the requirements of today’s highly competitive market and demanding customers.

So it’s no surprise we can see more and more digital financial services emerge. Digital payments are among these, making up the largest FinTech market segment, according to Statista. Meanwhile, neobanking, digital investments, and assets are not so far behind.

Keeping up with such innovations is critical in the finance sector. Luckily, many FinTech businesses realize it and do their best to implement them as fast as possible. It’s where financial companies rely heavily on DevOps engineering.

This methodology enables the automation of many business processes, accelerates the rollout of new features, increases the reliability of digital products, and ultimately leads to more satisfied customers. While these benefits may sound great, you need a reliable DevOps vendor like S-PRO to leverage them.

Our approach is a strong FinTech focus with all industry requirements in mind. Having delivered over 50 successful financial projects, S-PRO will tell you about the advantages, challenges, and best practices of implementing DevOps.

What Is DevOps, and How Does It Work?

First things first: let’s figure out what DevOps is.

It’s an acronym from the words ’development’, which includes planning and building a digital product, and ‘operations,’ which include the project’s release, deployment, and ongoing support. Combining these two processes, DevOps is a methodology for smooth interaction between development and operations teams.

Before DevOps emerged, companies experienced one critical issue. When a dev team handed the code to an operations team, any problems arising on the ops’ side were the developers’ sole responsibility. Because of this, many products were released late or with defects.

The DevOps methodology appeared to solve such issues. It enables more productive collaboration than other, more conventional approaches to software development by using particular practices and tools.

Today we’ll discuss these practices in more detail. First, let us give you a hint of some of them. The primary concept of the DevOps approach is the production of small and incremental updates. This strategy also implies better communication between teams. All this allows for rolling out a digital product to the market faster and improving its overall quality.

When it comes to the practical use of this methodology, engineers for operations and development are needed.

What is a DevOps engineer? It’s an expert who understands all possible dev and operation processes. These include development, testing, product architecture, security risk assessment, various automation methods, and product support before and after release.

DevOps and Finance Industry: Brief Overview

Just a few years ago, financial institutions were reluctant to change. And we understand why: to implement any innovation, businesses had to meet numerous regulatory requirements, including data security.

Yet, everything has changed, and we see a sharp shift both in the needs of customers and in the means now used by financial companies. We are also witnessing rapid growth in the FinTech market. If in 2020, its value was $110 billion, then in 2030, it will be almost $700 billion.

As for the widespread changes that financial organizations can expect, it is the automation of their processes. According to the Deloitte 2020 survey, almost 29% of financial companies noted a significant impact of automation, and over 51% expect such influence within the next five years. And DevOps can significantly facilitate routine process automation.

According to an Atlassian survey, 99% of organizations report a positive impact from implementing DevOps. In particular, 69% of companies testify to a significant influence, and 30% indicate just some positive changes within their organization.

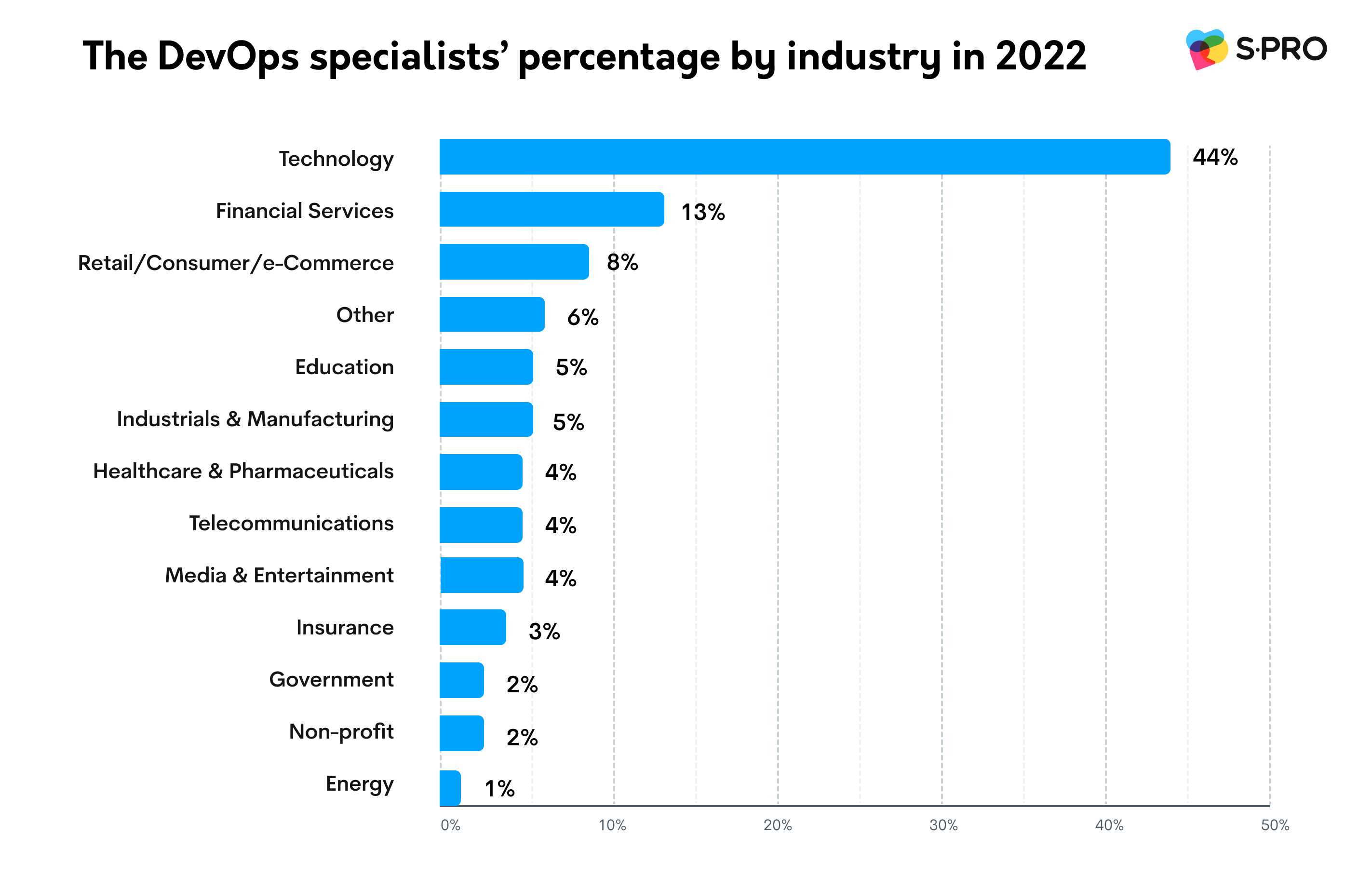

Following another study, we can see how critical DevOps teams are for the finance industry. The financial services niche has the second-largest number of DevOps engineers employed. Look at the DevOps specialists’ percentage by industry in the chart below.

Source: Google 2022 State of DevOps Report

Finance and DevOps cross when it comes to implementing the latest technologies for increased customer satisfaction and overall business performance.

Main Benefits of Using DevOps in FinTech

You probably don’t like when your finance app freezes. Perhaps, you’ll also react poorly if you cannot complete a transaction, as a digital banking platform won’t respond.

So, where are we heading? People expect stability from digital financial services. It means that FinTech products must be reliable, performant, and up-to-date.

It is exactly what DevOps will help you with. It’s your way to make a stable digital solution and back it up with constant improvements and no issues on board.

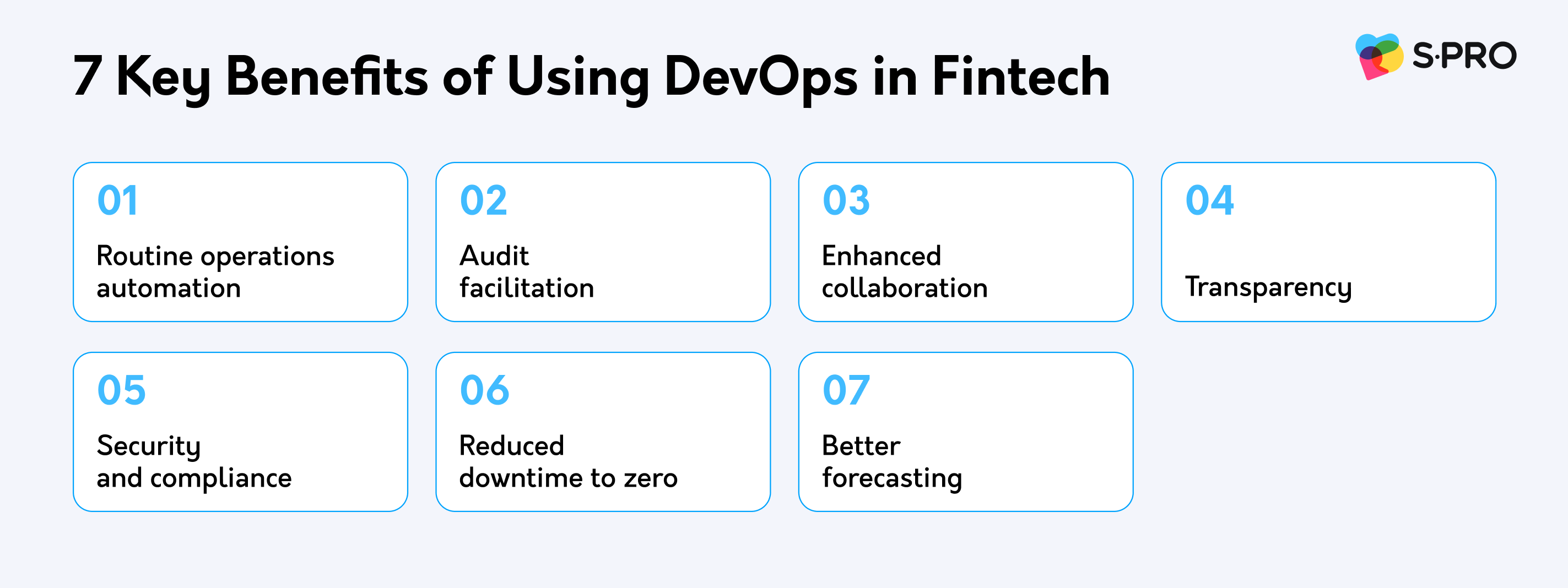

Take a look at the following benefits of DevOps engineering for FinTech:

Process Automation

You can streamline the day-to-day operations of developing and maintaining your software, rolling out updates, preparing for testing, and more. With a DevOps engineer, you can automate numerous manual tasks and no longer spend time on them.

Improved Cooperation

Establish communication between your teams using the DevOps methodology. Now all processes will be visible and transparent for each department, reducing potential misunderstandings and errors during the development and launch of your financial software.

Better Audit

As we’ve already mentioned, financial organizations must comply with numerous requirements. One of these is conducting a regular audit. DevOps tools make it possible to facilitate this process, including the ability to track and save all logs.

Advanced Security

Due to intense market competition, FinTech companies must constantly improve their digital products. And the sooner they implement various updates, the better.

However, hastily rolling out new features or updates can affect the digital product’s security level. Though if a FinTech business adopts DevOps, it may not worry about data breaches or cyber-attacks. That’s because developers will thoroughly test the code before releasing it to production.

Regulatory Compliance

When developing software using the DevOps methodology, you take care of its regulatory compliance only once. Then, you can use the same script when implementing new features or updates without spending extra time.

Lower Downtime

Implementing DevOps into your processes significantly reduces downtime, which can be costly for your organization. Some DevOps tools, such as microservices, enable digital banking development modularly, reducing deployment delays.

Better Forecasts

Thanks to the automation of many processes and improved control over them, you can make more accurate predictions regarding your FinTech software development. It will also help to understand your customers better.

Potential Challenges of Using DevOps in FinTech

Despite the many benefits DevOps offers to the financial sector, its adoption still has some challenges. Here are the potential obstacles that a FinTech company may face:

- Slower migration from legacy systems to new ones

- Higher cost of errors

- Strict regulatory requirements

- Infrastructure scaling issues

Hiring a reliable DevOps company can easily ground the issues listed above. Efficient tools and practices your vendor will use will reduce the impact of negative factors to a minimum.

But what are these practices and tools that we keep mentioning? Read on to learn more about them.

DevOps Best Practices for Finance Businesses

DevOps significantly facilitates finance companies, helping them to deal with security, regulatory, and, of course, customer requirements. Yet, FinTech businesses need a well-thought-out DevOps implementation strategy to succeed.

The good news is that we can help with that. Look at the best practices you may apply to make the most of DevOps methodology.

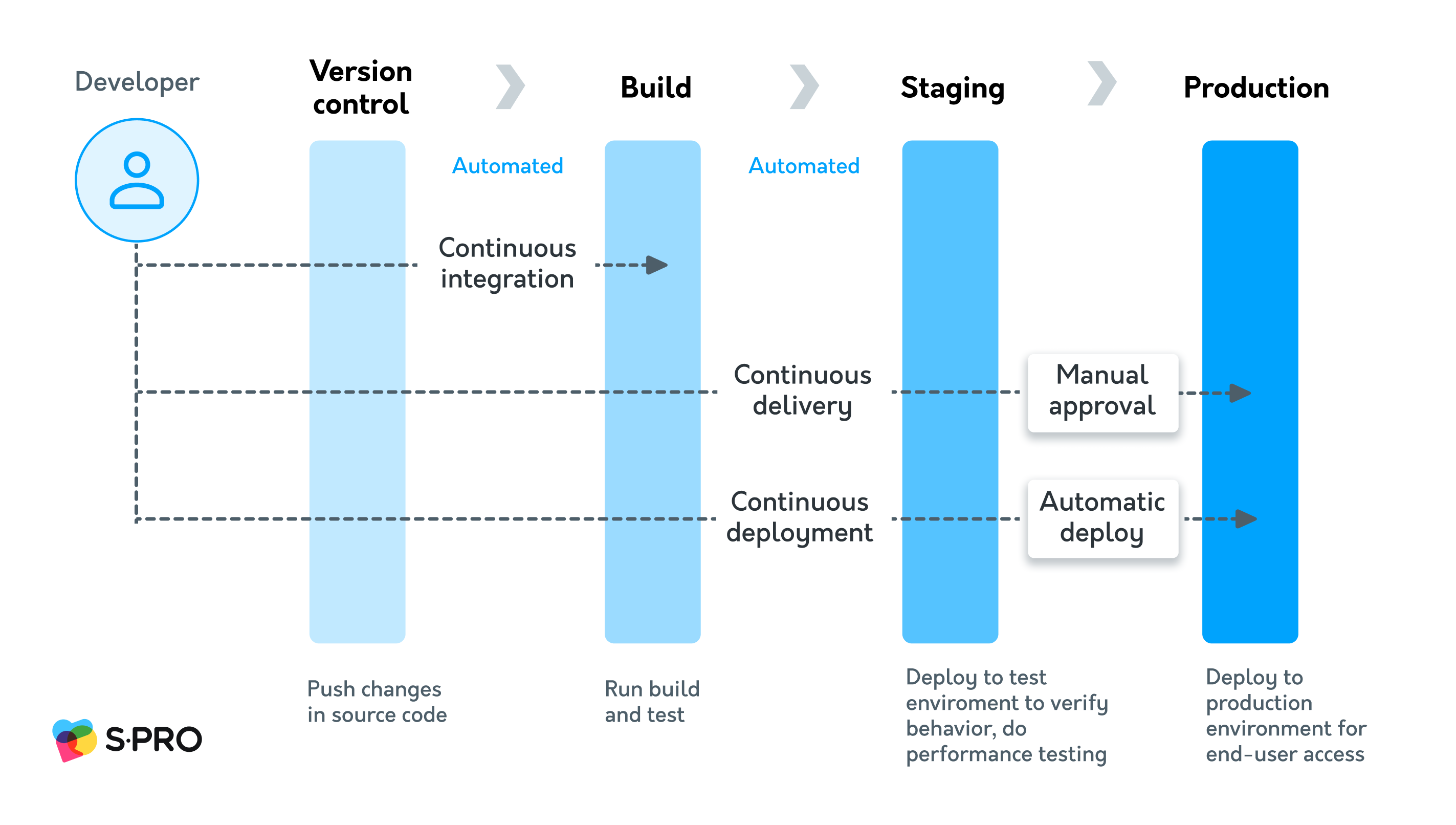

CI/CD

CI/CD stands for continuous integration and continuous delivery. The first process is responsible for frequent code integration and instant automated testing. It makes continuous delivery possible, which, in turn, involves the creation of software in small, fast, and frequent cycles. All this allows for a speedier software release, making it safer and more bug-free.

Learn more about this process in the picture below:

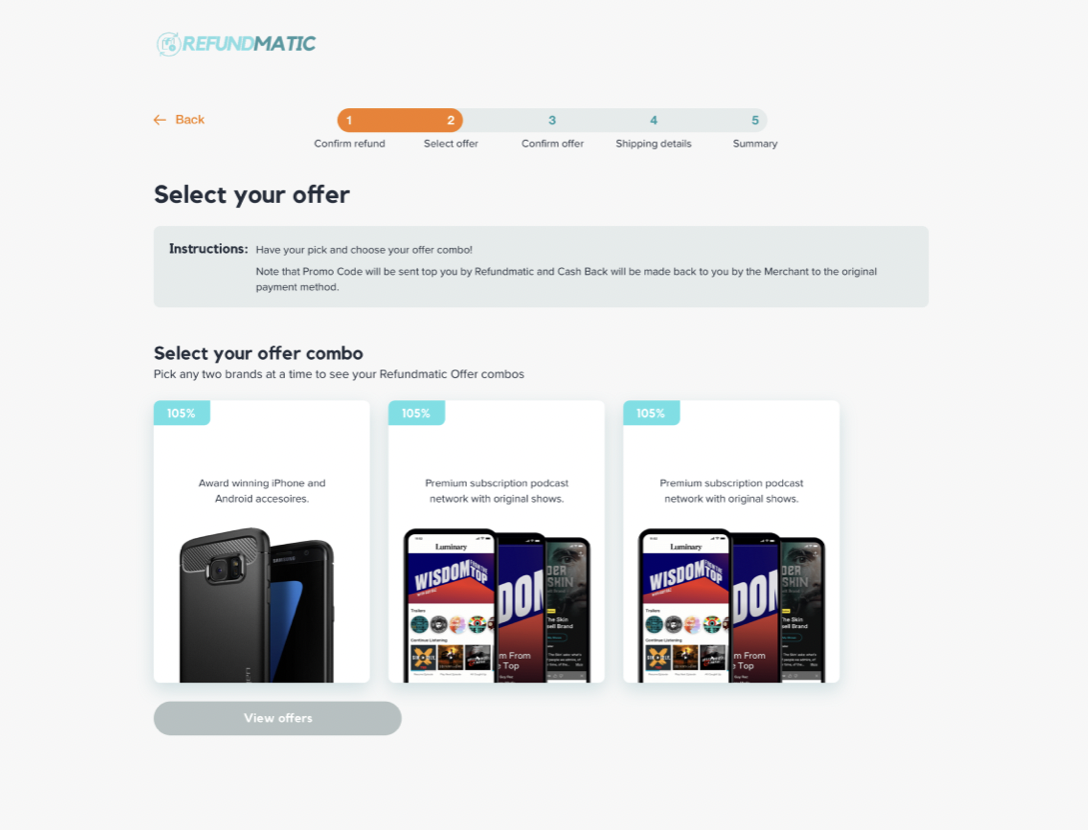

We used CI/CD practice for one of our FinTech projects — Refundmatic. It’s a platform that allows users to receive refunds from third-party brands.

Our team engaged in DevOps activity at a zero sprint, and within ten weeks, we delivered the MVP. After that, we proceeded with the continuous development of Refundmatic in two-week iterations, resulting in a dynamic and secure FinTech product. On top of that, we completed the project on time and within the agreed budget, using a thoughtful DevOps strategy.

Continuous Testing

CT or continuous testing is another DevOps practice. It involves conducting automated testing at all stages of the product development life cycle. You get timely bug fixes and fewer expenses by constantly checking the software for limitations and errors.

Configuration Management

Configuration management (CM) is a practice that allows you to manage the configurations of all software and hardware by saving all the data about them.

Infrastructure as Code

IaC, or Infrastructure as Code, is an approach that enables automated infrastructure management. Thanks to it, you can develop and deploy cloud software much faster and with lower security risks.

IaC is about documenting your infrastructure and providing step-by-step instructions for setting up a new development environment for your project.

Right DevOps Tools and Cloud Technologies

You also require specific tools to implement DevOps best practices. Owing to them, you will be able to automate and accelerate the processes of development, testing, deployment, and scaling of your digital product. Here are some of the most popular ones:

- Jenkins, GitLab, or Bamboo for CI/CD automation

- Appium, Test Sigma, or Selenium for continuous testing

- Kubernetes or Docker for containerization and virtualization

- Orchestration tools

- Workload planning tools

- Version control tools

- Pipelines for automatic release and deployment

Furthermore, the DevOps methodology is suitable for working in cloud environments. In particular, you can use such cloud platforms as Azure or AWS.

How AI Has Transformed DevOps in FinTech?

AI enormously impacted DevOps in financial services. DevOps in FinTech sector quickly adopts GPT and generates code to optimize its functions. Here is how exactly has AI transformed DevOps for FinTech:

- Continuous Automation & Integration: AI makes continuous integration and delivery processes more efficient through ML. It manages data and risks, eases code generation, provides activities’ real-time tracking, code review features, etc. Besides, AI-powered QA tools analyze previous test data, enhancing test accuracy.

- Better Software Quality: AI- and ML-driven CI/CD pipelines improve DevOps in FinTech’s workflow automation and code quality, reducing errors, release time, and costs.

- Predictive Analytics & Alerts: AI transforms system monitoring. It analyzes logs and alerts, displays and fixes potential issues, manages application delivery tracking, and allows proactive supervision.

- Security & Risk Management: AI improves cyber security in DevOps for FinTech. It foresees threats, responds promptly, saves time, and remains secure against cyber threats.

- Personalized User Experiences: AI can analyze user data, such as search requests and navigation, to predict user behavior and preferences.

- Resource Management: AI uses analytics to optimize computing resources, transform cloud solutions, and improve resource allocation.

Information-sharing: AI tools reduce manual updates for DevOps in financial services, minimize errors, and automate document modifications and team communication.

DevOps for FinTech: Discussing Best Hiring Approaches

If you want to implement DevOps, you are probably interested in ways to hire DevOps specialists. For example, is it better to involve an in-house team or outsource? Let’s figure it out.

Building your own in-house DevOps team can be time-consuming and usually more expensive. However, this way, you get dedicated specialists who will be managed right from your office. This hiring approach is great for large companies with extensive infrastructure.

What is DevOps engineer in the outsourced approach? Such specialists are often considered unreliable as they work outside your company. However, this approach offers many advantages, including significant cost savings and a large talent pool. Outsourcing is great for startups and small and medium-sized businesses for short-term and long-term projects.

Final Thoughts

DevOps is a driving force for the FinTech sector. With the help of this methodology, financial companies can streamline their digital products’ development and, at the same time, produce regulatory-compliant software of advanced quality.

Moreover, DevOps adoption means being able to meet market and customer requirements. It’s possible because this approach allows you to innovate your products easily and quickly.

If you are looking for a reliable DevOps company that will take your financial services to the next level, then you are in the right place. We at S-PRO are experts in FinTech and use DevOps to create reliable and performant products. We have numerous satisfied clients worldwide. If you want to become one of them, just drop us a line.

Frequently Asked Questions

How to adopt DevOps in my FinTech business?

Our advice is to start with small, incremental steps. You don’t need to apply all the best practices at once. First, outline the implementation plan and scope of work, and start your DevOps adoption.

Why do FinTech companies need DevOps?

Such highly-governed institutions need DevOps, as it allows them to streamline digital product development and maintenance processes, which is critical in the rapidly growing, competitive FinTech sector.

Can DevOps help with a digital transformation of my financial business?

Yes, it certainly can. DevOps can help manage new deployments and infrastructure, as well as the transition from legacy systems to new ones.