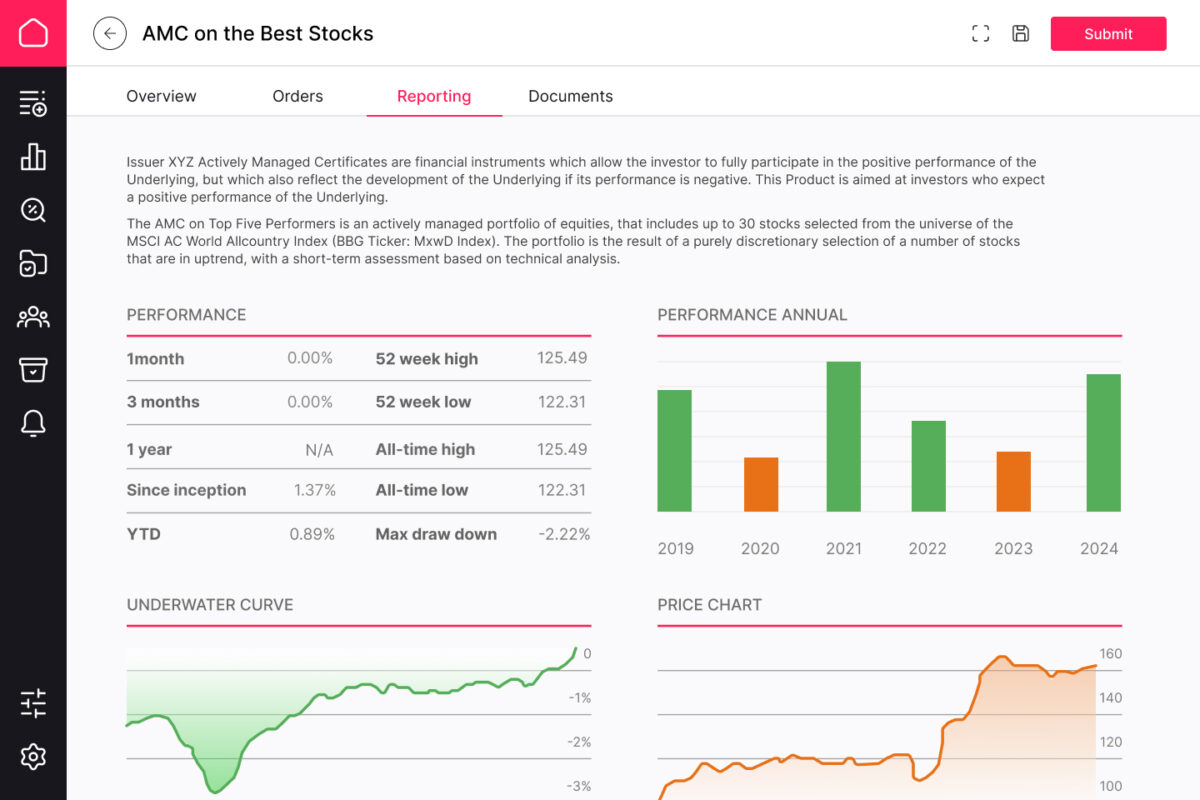

Exchange-traded notes (ETNs) provide seamless access to specialized markets, making them a versatile asset management option. Using sophisticated technology, these debt securities track the value of underlying assets, such as commodities or emerging industries, without holding them. This approach guarantees clear and dependable performance tracking for investors with minimum error.

Ideal for investors seeking diversification, ETNs allow you to customize portfolio returns while exploring opportunities beyond traditional markets. With their unique structure and broad selection, ETNs are a versatile tool for achieving financial goals.