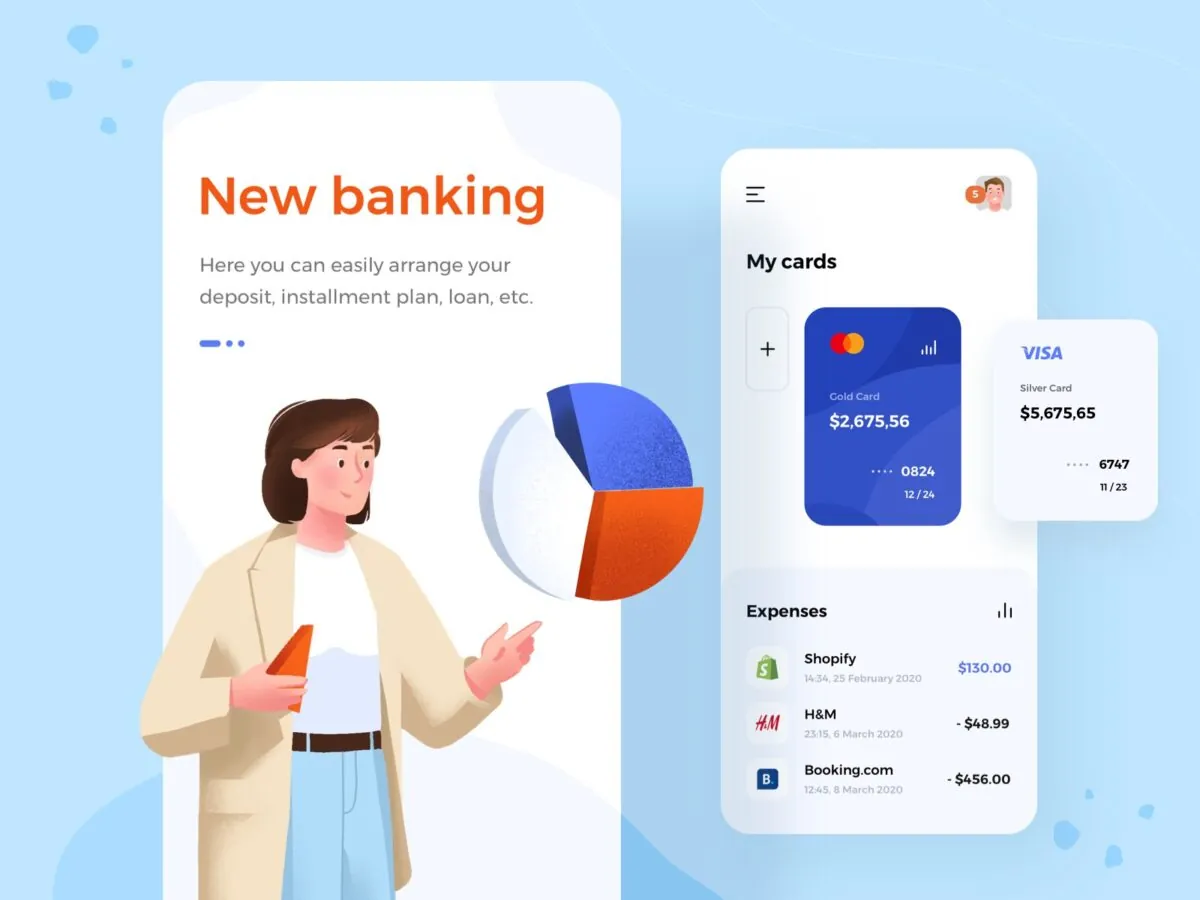

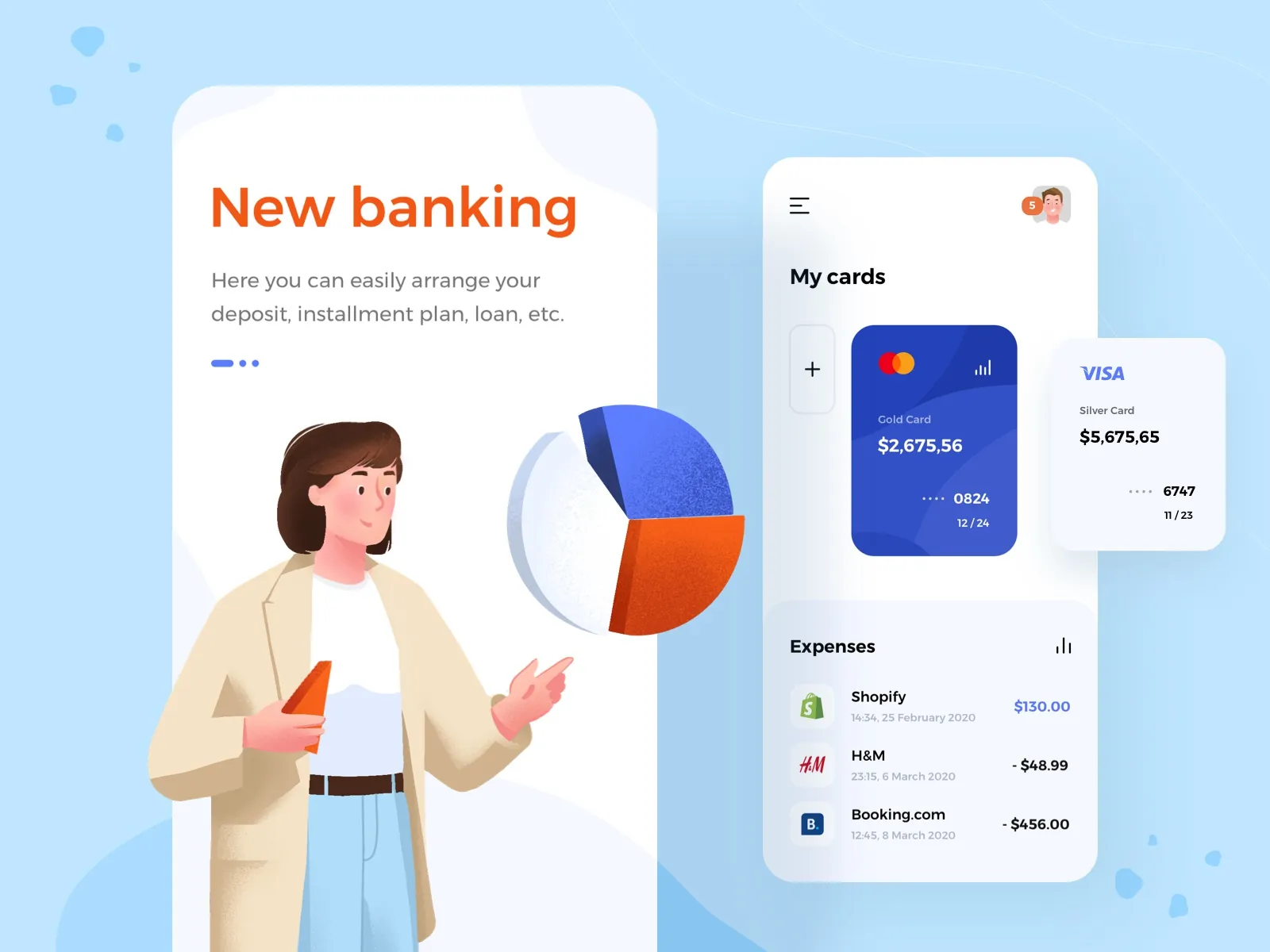

Illustrated by Taras Migulko

Today is featured by the fast transition into the digital world. After the global lockdown, many businesses have started rethinking their processes, and the banking industry isn’t an exception. We witness the increasing demand for mobile applications in the financial sector. Many modern banks are developing their own apps to stay in touch with their customers anytime and from anywhere, regardless of a lockdown.

Do you also want to address the new needs of your tech-savvy customers in the digital age and learn more about the pros and cons of mobile-only banking? Here is everything you need to know to develop a mobile-only banking app:

- What is mobile-only banking and how does it work?

- The main features of mobile-only banks.

- Pros and cons of mobile-only banking.

- The state of mobile banking and the biggest industry players.

- Things to consider before developing your own mobile-only banking app.

What Is Mobile-Only Banking and How Does It Work?

We may admit that mobility has become one of the key factors of business success in various industries. Consequently, digital banking is now quickly adopting the mobile future too. The world has recently seen the birth of a new type of banking — a totally mobile one. Arisen just recently, mobile-only banks are gaining momentum in 2020. These are banks that live only in mobile phones. In other words, they are accessible only via apps on your smartphone.

Unlike traditional banks, mobile-only banks have neither branches in real-world nor online desktop versions. They are also called neobanks or digital-only banks. Australia has pioneered in this mobile innovation. In 2018, Up became the first mobile-only bank launched in the world. At that time, it had only the two core features, a transaction account and savings account. In February 2020, Up was also named the 2020 Mozo Experts Choice Award Everyday & Savings Bank of the Year.

The Main Features of Mobile-Only Banks

Although mobile-only banking is a recent innovation, the financial industry has already formulated the key features that a great mobile-only application must have. They include a set of common financial operations, advanced cybersecurity, round-the-clock customer support, and smooth user experience.

Financial operations

First of all, such an application should have basic online banking functions and work as a digital wallet and a bank account. It lets users securely keep, monitor, and manage their earnings. A mobile-only banking app should allow easy transferring funds between users, making deposits, and paying for products or services online. Some mobile-only banks also provide small loans.

Advanced cybersecurity

The first and foremost requirement for any kind of financial service is to be highly secured. However, when it comes to cybersecurity in online banking, everything sounds even more serious.

Security has paramount importance for mobile-only banks. A well-protected digital banking app should have a set of features, like end-to-end encryption, multi-factor authentication, safe back-end architecture, and other the best cybersecurity practices available in the IT industry today. Also, it must comply with all important regulations, such as GDPR, Open Banking initiative, and other location-specific requirements.

Round-the-clock customer service

Like with any other online service, customers appreciate it if a support team is easily accessible. In the case of mobile-only banking, it is even more important. In order to avoid customer anxiety and concerns related to savings on their accounts, mobile-only banks provide round-the-clock customer support. It means that if you have faced any confusion when using a mobile-only bank app, you can contact a customer support team and be assisted at any time. A dedicated and empathic customer support service is key to success of a digital-only bank.

Intuitive and smooth user experience

Unlike physical banks, mobile-only banks can provide a much more engaging user experience. Modern mobile-only banking applications gain customer loyalty by offering a seamless user experience, gamification of in-app elements, real-time notifications, reminders, and even assistance provided by animated heroes.

Pros and Cons of Mobile-Only Banking

Illustration by Uran

Why choose a mobile-only banking app? There are plenty of ways how both customers may benefit from it. Traditional banking apps often feel clunky and have limited functionality because some of the features are available only in a web-based version. On the contrary, mobile-only banking applications completely satisfy the needs of the fast-increasing mobile society and allow taking full control over finances without the need to come to the banking office in real life.

Mobile banks usually add to their apps plenty of functions that help customers manage money more efficiently. The ability to see real-time transactions, quickly split bills with your friends, and use your cards abroad without any fees — these are just a few of multiple amazing features that attract so many users worldwide and make mobile-only banking a new digital trend.

Advantages

Simplicity. Many hundred years ago, Leonardo da Vinci said that simplicity is the ultimate sophistication. This straightforward truth is still relevant for us today, especially in mobile-only banking. Simplicity is what makes mobile-only banking apps so appealing to millions of users worldwide. Setting and using such apps is really breezing. Commonly, they have pretty simple, basic features that don’t require any special effort to manage them. Mobily-only banks strive to simplify customer experience at maximum. For instance, BankMobile offers users an option to pay for their bills just by taking a photo of the bill.

Lower fees. One more flavor of digital banks is lower fees. They don’t need to work with humongous bureaucratic machinery, consequently, they can offer lower fees for their customers. For example, GoBank doesn’t charge any overdraft fees, while BankMobile doesn’t require any fees at all. It makes mobile-only banking an even more attractive option for people across the world.

Real-time notifications. It is one more appealing advantage of mobile-only banks. By sending real-time updates, notifications, and even on-demand reports about spendings or income, mobile-only banking companies keep their customers always well-informed about their financial situation. It can be an additional reason for gaining their loyalty.

Financial projections. It’s an interesting feature offered by some digital-only banking apps. It allows you to estimate your average earnings, spendings, and funds movement and forecast the changes in your budget and financial situation for the month ahead.

Integrations with other financial assistance apps. There are a lot of convenient financial tracking and budgeting apps available in the app store today. One more alluring benefit of most of the mobile banks is that they provide useful integrations with other fintech apps that make your financial experience even more enjoyable.

Disadvantages

Although there are so many amazing pros of mobile-only banking apps, there are also a few disadvantages. To make a well-informed decision, you must be aware of both sides of the coin.

Impossible to open a joint account. If you need a really comfortable solution to manage simple banking operations, then a mobile-only banking app is likely the best choice. It is created to be used by a single person. In the case if you need to create a joint account, you should look for another option since it is not currently available in mobile-only banking apps.

Market accounts and mortgage loans aren’t available. Mobile-only banking apps are perfect for easy checking out. However, if your demands for financial management go beyond the basics, then you need to turn to digital banks.

Depositing cash is challenging. It can also be an obstacle because you need to add cash to another account or your debit card first. And only after this, you can transfer it to your mobile-only bank.

Lack of face-to-face support. The lack of the human-to-human interaction may lead to the lack of flexibility in services and transactions. All in all, we all sometimes need to talk with a real consultant to understand how to manage our financial issues the most efficiently.

The State of Mobile-Only Banking and The Biggest Industry Players

Several forward-thinking fintech startups have predicted the quiet digital revolution and invested in the launch of mobile-only banking apps. You might have never heard about them if you’re outside the UK, but they’ve actually taught great lessons to the British financial system and challenged major traditional banks. Monzo and Starling are among the first and the best mobile-only banks that look like applications for iOS and Android.

Illustrated by Katarzyna Dziaduś

Monzo and Starling have attracted new customers with a great number of features that make financial management easier than ever. One of the most prominent features is the ability to send money to friends and fee-free transactions overseas easily. Starling even provides location-based fraud protection that allows freezing transactions if they don’t match your mobile phone geolocation.

Providing a whole new level of mobility and convenience in operating the finances on the go, Monzo has recently crossed 2 million customers. At the same time, over 550,000 customers have already trusted their hard-earned cash to Starling. These are just two of those incredible examples demonstrating the ever-increasing popularity of mobile-only banking among millennials and members of Generation Z.

Eurostat has reported that the percentage of European citizens leveraging digital banking has doubled between 2009 and 2019. As per Fortunly, it’s expected to see even more than 3.6 billion active online and mobile banking users by 2024. This exciting data shows us the massive impact of digital transformation on this field, as well as the urgent necessity in rethinking financial services and adjusting them to the new normal.

To get more Fintech insights, read Fintech Security and Compliance best practices.

5 Things to Consider Before Developing Your Own Mobile-Only Banking App

Illustrated by VikesTan

To build a robust mobile-only app, you need to understand the development process and know a few essential things. Let’s briefly consider them.

Security and encryption

Cybersecurity has become one of the top digital transformation trends. It also means that today’s digital products are exposed to quite often cyberattacks, and you should be combat-ready to them. According to the latest mobile banking statistics provided by Fortunly, banks across the globe lose more than $1 trillion due to the cyberattacks every year. That’s why security has the paramount importance for a mobile-only banking app’s success.

You should determine what security features you want an app to have and check if they comply with the government requirements. After this, you have to select and install the latest signature technologies to protect your mobile application. Don’t forget to install an encryption program for storage cards.

We also recommend adding a password strength checker to ensure that the user will type only a strong password and secure banking accounts better. It’s also advisable to review security policies to see how mobile devices are utilized in your network.

App sandboxing

The crucial step is testing an app in a sandbox environment. Sandboxing your mobile application is an excellent way to secure your systems and users by restricting the privileges of an application to its intended functionality, increasing the difficulty for malware to compromise your end-users’ systems. In other words, this environment protects your future application from potential threats and dangers.

Minimalist UI and intuitive UX

It’s essential to invest time and effort in creating brilliant user experience and user interface design for your mobile-only banking app. It’s recommended to make it minimalist and straightforward in order not to overload the user with unnecessary details and help concentrate on the key financial information.

The primary goals of the UX design for mobile banking app include providing psychological comfort and keeping things clear and easy-to-understand at maximum. When it comes to financial management, it’s particularly important to care about a perfect UX, smooth user interaction, and avoid the user’s cognitive overload.

Our mind is especially sensitive when dealing with essential operations and financial information. An excellent UX design can help you prevent negative user experience and increase customer satisfaction from using your fintech application.

User Testing

In the best scenario, mobile app development is a continuous process that implies multiple tests, iterations, and improvements. It’s better to stay in touch with a team that has helped you create your mobile-only banking app to ensure reliable tech maintenance for it. However, if it’s impossible for some reason, an application should go through a number of user tests before it is released to the market and introduced to the world.

You should consider the diversity of your target audience and predict that your people may use different mobile devices. Thus, you must be sure you have tested your newly born application with various devices and target groups.

Compliance with government regulations

Although it’s the last point in the list, it’s also one of the most fundamental things to know about mobile-only app development. When an app is tested and ready for a launch, you will need to get a financial license from the government. Your digital product should comply with absolutely all government regulations. Therefore, it’s vital to check once again if your app corresponds to security policy.

Closing Thoughts

Like everything in the world, the banking industry is rapidly evolving too. The recent digital transformation has brought a lot of disruptions, innovations, and opportunities in the financial sector. Mobile-only banking has become the implementation of tech-savvy customer needs, emerging technologies, and financial management — all this can be brought to reality in a single mobile app. It is a new digital transformation trend that is gaining popularity today and quickly entering our lives.

At S-PRO, we hope this guide has shed light on the essentials you need to know to make a mobile-only banking app that will be quickly loved by your audience. If you are looking for a reliable technology partner and digital transformation consultant, don’t hesitate to contact us to learn how our expertise and domain knowledge can help you implement your mobile app idea.