Empower your business and protect user identities. Use KYC as a service to streamline the customer onboarding process, enable frictionless transactions, and protect against fraudulent activities.

Success stories

CH

CH

US

US

UA

UA

AU

AU

CH

CH

CH

CH

FR

FR

CH

CHKYC Services

ID Documents Verification

- Advanced Optical Character Recognition (OCR) technology

- Document authenticity checks

- Biometric matching techniques

- Employing machine learning algorithms

- Real-time verification capabilities

- Integration with compliance databases and watchlists

- Customizable verification workflows

Face Matching Service

- Utilizing facial recognition algorithms

- Liveness detection techniques to ensure the authenticity

- Real-time verification feature

- Cross-channel authentication across multiple platforms and devices

- Compliance integration

- Customizable workflows

- Integrating user consent management mechanisms

Biometric Verification

- Biometric SDK evaluation

- Biometric data capture integration

- Biometric template management

- Developing or integrating biometric matching algorithms

- Implementing liveness detection mechanisms

- Integration with identity verification workflow

Liveness Check

- Adaptive detection techniques (based on behavior and conditions)

- Implementing multi-modal biometric verification techniques

- Providing real-time feedback and guidance to users

- Integrating the liveness check feature into the existing KYC workflow

- Anti-spoofing countermeasures

AML Watchlists Screening

- Acquiring up-to-date AML watchlists from reputable sources

- Automated processes to retrieve and synchronize watchlist data

- Data normalization and standardization

- Integrating watchlist screening functionality into the KYC system

- Risk scoring and prioritization

- Generating alerts for potential matches or hits

- Suspicious activity reporting

Proof Of Address

- Automated address standardization

- Integrating geolocation verification techniques

- Implementing blockchain-based timestamping

- Document processing functionality

- Integrating OCR technology

- Machine learning address parsing

- Multi-layered verification processes

Why You Need KYC Service

- Ensure Full Compliance

- Avoid Fraudulent Activities

- Expand Global Business Opportunities

- Cost-Effective Quality

- Improved Due Diligence

- Document-Driven Verification

KYC AML providers help businesses comply with regulations by offering flexible user verification methods, Proof of Address (PoA) checks, Anti-Money Laundering (AML) screening, and customizable questionnaires. Partner with S-PRO to ensure your company meets legal requirements and regulatory standards.

Do you need multi-layered protection against various types of fraud, including synthetic fraud, identity theft, and document forgery? By implementing robust verification processes, businesses minimize the risk of fraudulent activities, protecting both themselves and their customers. Take a proactive approach to avoid financial and reputational losses.

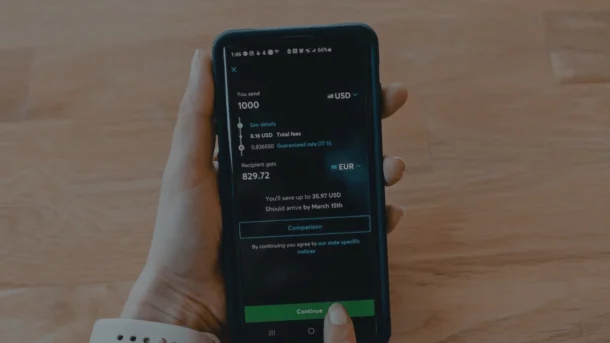

Attract more customers globally, facilitate expansion into new markets, and get other opportunities for growth. KYC service providers enable seamless onboarding and user verification processes. This lets companies verify users worldwide in under 50 seconds while maintaining high pass rates and enhancing the client experience.

Traditional compliance solutions often cost a lot, which makes them inaccessible to small companies with limited budgets. However, KYC platforms offer more flexibility, depending on your business needs and financial capabilities. Whether you’re a small startup or a large corporation, we provide various pricing models to implement necessary compliance measures within your budget.

Uncover hidden company details like financial statements and ownership structures with KYC services provider. This deeper level of scrutiny will help you make informed decisions and mitigate risks associated with potential clients or partners. It’s a great way to enhance trust and confidence in business relationships.

Utilizing advanced Optical Character Recognition (OCR) technology, KYC vendors let you extract information from business documents and verify them against official databases. This document-driven verification streamlines the onboarding process, reducing manual effort and ensuring accuracy in identity verification. Also, it improves operational efficiency and reduces the number of errors.

Process

Technology stack

Programming Languages

- Python

- Java

Frontend

- HTML

- CSS

- JavaScript

Frameworks

- React.js

- Vue.js

- Angular

- Express.js

- Django

- Spring Boot

Databases

- MongoDB

- MySQL

- PostgreSQL

Identity Verification for KYC Solutions

- Tesseract

- Amazon Textract

- Microsoft Azure Face API

- AWS Rekognition

- Jumio

Cloud Platforms

- Microsoft Azure

- AWS

- Google Cloud

Machine Learning

- PyTorch

- TensorFlow

- Keras

Our Case Studies

Facts aboutS-PRO

Why Customers Choose Us

Our specialists believe that UX is paramount. We prioritize an unparalleled user experience with a seamless and intuitive process for proper verification. Partner with S-PRO and let users effortlessly capture and submit their identification process with minimal effort. The system automatically detects and processes the ID image, ensuring accuracy and completeness in the verification process.

It is not enough to simply develop a KYC service — it is important to incorporate it into your existing systems and workflows. S-PRO’s solutions are designed to seamlessly integrate with various platforms, including web applications, mobile apps, and enterprise software. You shouldn’t worry about disrupting operations or requiring extensive modifications.

We prioritize the security of sensitive customer information, ensuring that data collected during the verification process is protected from unauthorized access, breaches, or misuse. For example, our specialists implement robust encryption techniques and access controls. As one of the reliable KYC providers, we also adhere to industry-leading compliance standards, including AML and KYC regulations.

S-PRO’s global presence and strategic locations ensure convenient collaboration and swift problem-solving. With headquarters in Switzerland, representations in the Netherlands and the USA, and dedicated R&D centers in Poland and Ukraine, we cover multiple time zones. Enjoy effective communication channels and responsive support services to address your needs.

Our team adopts an Agile approach to project management and development, emphasizing flexibility, adaptability, and collaboration. We use iterative development cycles and continuous feedback loops to deliver high-quality KYC as a service solution that meets evolving regulatory requirements and customer needs.

S-PRO’s seasoned professionals have extensive expertise in software development, compliance, and regulatory affairs. We are experienced in various identity verification technologies like biometrics, document verification, facial recognition, etc. At the same time, our experts know how to deal with industry-specific challenges and employ emerging technologies like artificial technologies and machine learning.

Frequently Asked Questions

How does the KYC solution work?

The KYC solution verifies the identity of customers by collecting and analyzing their personal information and identification documents. By conducting risk assessments and compliance checks, the solution identifies potential risks associated with each customer. It’s crucial for ensuring adherence to regulatory requirements and mitigating the risk of fraud or identity theft.

How much does KYC cost?

The cost of KYC service varies depending on the solution complexity, the volume of required verifications, and additional features or customization. Often, businesses pay subscription fees or transaction-based charges for using KYC solutions. Contact S-PRO, a trusted KYC provider, to discuss the details and get an accurate calculation.

What industries benefit from KYC services?

Industries across various sectors benefit from KYC products, including finance, banking, insurance, real estate, eСommerce, and telecommunications. Any area that involves customer onboarding, transaction processing, or regulatory compliance can leverage KYC verification service to enhance security, mitigate risks, and streamline operations.

- Drop us a line:

- Contact us: