The tokenized real-world asset (RWA) market is no longer a footnote in blockchain discussions. It’s a market that jumped from about $15.2 billion in December 2024 to over $24 billion by June 2025 – an 85% year-on-year climb.

It’s a signal that institutions are moving past pilots and into real deployment. This kind of expansion reflects maturing infrastructure, regulatory clarity in key jurisdictions, and growing confidence among asset owners that tokenization can reach mainstream audiences. What was once a proof-of-concept exercise for fintech labs is now something asset managers are putting into production, with measurable capital flowing through these systems.

Forecasts tell a similar story. Depending on who you ask, the global asset tokenization space is pegged into the trillions with double-digit annual growth. The difference between conservative and aggressive projections often comes down to assumptions about regulation and interoperability. If cross-border token standards align and institutions adopt secondary markets at scale, the jump to trillions becomes plausible. For businesses, this means early movers may have a short-lived but valuable window to define categories and win investor trust before the market becomes crowded.

A Simple Look at Tokenization Fundamentals

At its core, real-world asset tokenization is about representing physical or traditional financial assets – think real estate, private credit, commodities – as digital tokens on a blockchain. This allows fractional ownership, 24/7 trading across markets, and contracts that execute themselves when conditions are met.

The technical layer is important, but the business impact is where the real story lies. By breaking assets into smaller, tradable units, tokenization changes who can participate in a market, how quickly they can enter or exit, and even how asset-backed products are designed in the first place.

For many, it’s about access. Tokenization can open the door to assets that most people would never touch under traditional systems. A retail investor can put $100 into a high-value commodity. A fan can own a fraction of a championship ball. And for businesses, it’s a way to bring in retail investors, create new liquidity, and even run creative campaigns that turn customers into stakeholders. This isn’t just a fundraising gimmick – in some sectors, it’s already reshaping loyalty programs and customer acquisition strategies, blending finance and engagement in ways legacy tools can’t.

Why Tokenization Is Entering the Mainstream

In markets like the US, Switzerland, and Benelux, tokenization solves some stubborn problems in legacy finance. Traditional infrastructure is costly. Market access is often gated by intermediaries. Asset managers dominate the landscape, leaving little room for new entrants. For example, secondary market settlement in traditional securities can take days and involves multiple clearing entities. In a tokenized environment, those same trades can settle in minutes or seconds, freeing up capital and reducing counterparty risk.

Tokenization can lower costs, target a new kind of investor, and appeal to younger wealth holders who see crypto as more attractive than deposits or gold bars. These investors often value speed, global reach, and transparent ownership records – features that tokenization naturally supports. For asset owners, it’s not just about unlocking new capital; it’s about reshaping their investor base to include a generation that will dominate wealth distribution in the coming decades.

What Tokenization Can and Cannot Deliver

Tokenization isn’t magic and it won’t conjure liquidity out of thin air. It’s a tool – one that works when paired with a solid market strategy and a genuine value proposition. Without active market-making or buyback programs, many tokenized assets can sit idle, frustrating investors and hurting credibility. This is a pitfall that early NFT projects experienced, and RWA players risk repeating it if they rely solely on the “novelty” of tokenization.

In practice, the technology side is often the easiest part. The real sticking points are legal complexity and go-to-market execution. Many jurisdictions still lack clear regulation. Switzerland, with its DLT-Act, is a rare example of a well-defined framework. In the EU, MiCA is a step forward but remains heavy and complex. The US, for now, offers one of the more attractive climates for launching projects. What’s clear is that regulatory clarity directly correlates with institutional willingness to participate – a lesson learned from the rise of regulated crypto custody providers and exchange-traded crypto products.

Legal Anchors That Matter for Tokenization

The choice of jurisdiction matters. Start in the wrong place, and you can burn time and budget on legal wrangling before you even launch. Switzerland’s approach, with register-based securities, gives clarity and investor protection. The EU’s MiCA is broader but requires more resources to navigate. In the US, regulatory expectations vary by state and activity but can be more straightforward for certain asset classes.

For global projects, adapting to multiple frameworks is a challenge. Platform architecture needs to be flexible enough to comply with different rules while maintaining security and investor confidence. This is where partnerships matter – aligning with legal advisors, compliance tech providers, and platform vendors who have proven multi-jurisdictional deployments can save months of trial and error.

How to Make Tech Implementation Easier

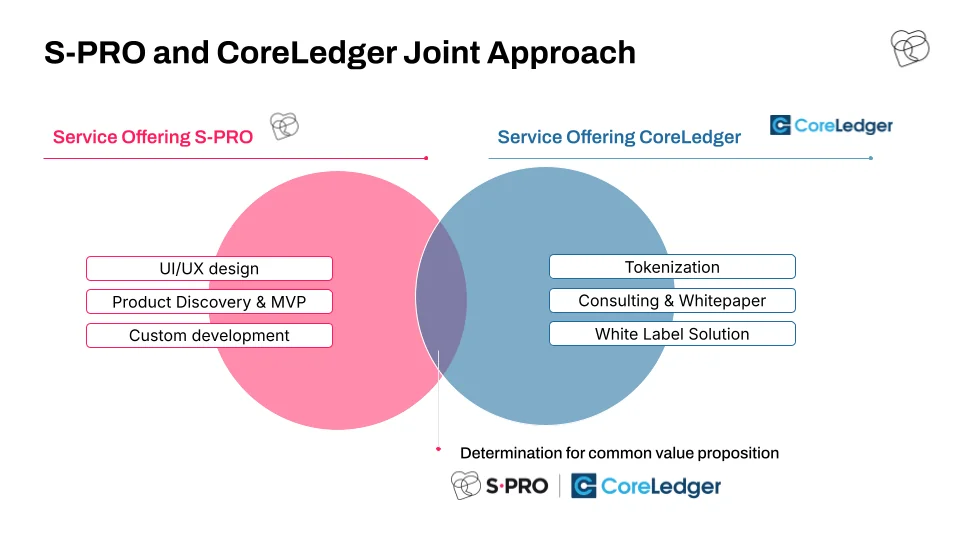

Tokenization may sound like a complex stack of technologies – frontend apps, backends, blockchain service layers, and the blockchain itself. Traditionally, building all of this from scratch meant high costs, long timelines, and steep learning curves. That’s where partnerships like S-PRO and CoreLedger come into play.

The joint approach is simple: CoreLedger covers the heavy lifting in the blockchain service layer with its whitelabel infrastructure, while S-PRO brings in custom development, UX design, and product discovery expertise. This division of roles reduces complexity and cost, allowing businesses to focus investment where it matters most – the frontend experience investors and issuers actually use.

There are 2 common paths:

- Whitelabel backend solution – CoreLedger provides ready-made modules for KYC, payments, and compliance, while S-PRO builds the investor- and admin-facing applications. The upside is speed to market and reduced custom effort. The trade-off is some limitations in business process flexibility and continuous service fees.

- Hybrid version – businesses add a custom backend alongside CoreLedger’s modules. This offers more control but requires careful architecture to avoid duplication.

The value comes when the two worlds meet. S-PRO focuses on design, MVP building, and tailoring products to market needs, while CoreLedger provides the tokenization backbone, consulting, and white-label solutions. Together, the offering gives businesses a faster route to launch, with a balance of customization and reliability.

For asset owners, this means tokenization isn’t a mountain to climb alone. It’s a partnership-driven process where technical hurdles are handled in the background, leaving space to build investor trust and focus on go-to-market strategy.

Tokenization Examples You Can Learn From

Some use cases are already in play. Music royalties have been fractionalized so fans can share in artists’ revenue. Sports teams can tokenize memorabilia or match-day assets to engage fans in new ways. Airlines could even offer frequent flyers a chance to buy a fraction of a plane they regularly travel on – turning loyalty into ownership and future yield. These are more than novelty plays; they create emotional attachment alongside financial upside.

On the institutional side, tokenized real estate and commodities are starting to gain traction. In private credit, tokenization can make illiquid instruments tradable in smaller denominations, opening access to new buyer segments. These models are especially compelling when paired with yield-generating structures, where investors see regular payouts rather than waiting for asset appreciation alone.

Risks in Tokenization Projects and How to Handle Them

The most common mistakes? Launching without a clear liquidity plan. Ignoring KYC and AML obligations. Underestimating the need for investor communication during downturns. Each of these can kill momentum faster than technical failure. Investors in tokenized assets expect the same – or higher – operational standards as they do in traditional markets, because the risks feel newer and less tested.

Liquidity can be managed through market makers or company buybacks, but that requires capital and planning. And when the asset’s value drops – whether from a market event or external shock – companies need a crisis communication plan to maintain trust and prevent panic selling. Without it, even a temporary dip can turn into a reputational blow that lingers.

Adoption Trends and Future Outlook for Tokenized Assets

In the next 12–18 months, expect more action in real estate, equities, and commodities. Carbon credits, green bonds, and supply chain assets could follow as standards and legal frameworks solidify. Institutional adoption will likely accelerate in verticals where tokenization solves a clear operational problem – like complex settlement flows or multi-party revenue sharing – rather than simply offering a new wrapper for existing assets.

To reach the trillion-dollar scale, the market needs more than growth in asset classes. It requires clear legal tools, industry-wide standards, and user experiences that feel safe and straightforward. Add institutional support – already visible from players like BlackRock and JPMorgan – and momentum will build. The key will be balancing innovation with operational discipline so that tokenized assets don’t fall into the same volatility trap that hit early crypto projects.

Practical Steps with Examples for Asset Owners Considering Tokenization

At S-PRO, we work on tokenization projects every day, so we’re constantly in touch with asset owners, institutional players, and industry leaders. The insights below don’t come from theory or buzzwords — they come from those conversations. These are the stories and lessons people have shared with us: the pains they’ve faced, the risks they’ve uncovered, and the successes that proved tokenization can work in practice. If you’re thinking about this path, their words are worth learning from.

1. Start with the right expertise

Don’t try to navigate tokenization alone. Partner with a consultant, agency, or hire someone who knows both blockchain technology and the crypto investor landscape. Even part-time expertise can save months of trial and error.

Example: A Swiss art gallery worked with a tokenization consultancy to fractionalize ownership of high-value pieces. Without their guidance on compliance and investor onboarding, the project would have stalled in the legal review phase.

2. Choose your jurisdiction wisely

Legal clarity is your foundation. Switzerland’s DLT-Act offers a clean starting point, while MiCA in the EU is heavier but workable. The US can be attractive for certain asset classes, but state-by-state differences matter.

Example: A commodity trading firm launched its tokenized gold program in Switzerland, taking advantage of the DLT-Act’s clear securities framework. This allowed them to attract both European and Asian investors without months of legal uncertainty.

3. Decide on your asset strategy early

Will you tokenize an existing asset or create a new structure? Each path has different compliance, marketing, and liquidity implications. Pick the one that matches your goals and target investors.

Example: A real estate developer in Dubai chose to tokenize newly built units rather than existing properties. The clean ownership structure and absence of legacy liens made it easier to offer fractional investments to foreign buyers.

4. Plan for liquidity before launch

Tokens without a way to trade are just static records. Consider market makers, buyback programs, or partnerships that give investors confidence they can exit when they need to.

Example: A private credit fund set aside 5% of capital for periodic buybacks of its tokenized debt products. This gave early investors the reassurance that they could cash out without waiting for maturity.

5. Make investor trust a priority

Transparent reporting, clear exit mechanisms, and proactive communication during market swings will keep your community engaged – even when asset values dip.

Example: A renewable energy project tokenized future revenue from solar farms. During a period of lower-than-expected output, they shared detailed operational data and offered partial redemptions, maintaining investor goodwill.

6. Don’t underestimate go-to-market

A technically sound token is worthless if no one knows about it or understands its value. Build a narrative that speaks to your investor segment, and plan your outreach before minting the first token.

Example: A sports club’s memorabilia tokenization project succeeded because they launched alongside a fan engagement campaign, complete with social media challenges, in-stadium QR codes, and influencer collaborations.

Wrap Up

Tokenization is about execution — legal frameworks, liquidity planning, and the stories of asset owners who are testing it in practice. At S-PRO, we’ve seen first-hand that the biggest lessons don’t come from whitepapers; they come from the conversations with people building these projects, dealing with setbacks, and finding creative ways forward.

If there’s one takeaway, it’s this: tokenization is less about technology and more about trust. Get the basics right, communicate clearly with your investors, and partner with the right people. The rest will follow.