Ever felt like you’re dealing with an iceberg of complexity when trying to make your physical products digital? So have many of our clients. From tokenizing real estate to building compliant fintech apps, the surface always looks simple. But beneath it? A bunch of technical, regulatory, and integration hurdles.

At S-PRO, we deal with these complexities. We work at the intersection of blockchain, finance, and AI to help businesses turn ambitious digital asset ideas into working products.

That’s why the Crypto Assets Conference (CAC) is a key stop on our calendar. It brings together the thinkers and builders of the next generation of digital finance, including those promoting institutional blockchain adoption and tokenization.

This year, we were proud to go beyond attending. At the CAC 2025 Pre-Event “Unlocking the Value of Real-World Assets by Digitization”, a focused session on the digitization of real-world assets, Michael Barskiy, Head of S-PRO Switzerland, joined the stage alongside our partners from CoreLedger. Together, they shared how to make tokenization simpler. More on that below.

What the Crypto Assets Conference Is and Why It Matters

Held annually in Frankfurt, the Crypto Assets Conference connects crypto and traditional finance leaders to debate the most pressing questions on digital assets, including:

- Real-world asset tokenization

- Decentralized finance (DeFi)

- Stablecoins and digital euro

- Regulatory developments

- Investments and venture capital

And the above are just a few topics. Other discussions range from AI-enabled finance to the adoption of Bitcoin, Ethereum, and other crypto assets in traditional institutions.

The CAC 2025 Pre-Event, hosted by CoreLedger, Finemetal, and S-PRO, was a deep dive into one of the most promising yet misunderstood topics: the digitization of real-world assets (RWAs).

While often framed as the “future of finance,” tokenizing RWAs is far from simple. The Pre-Event Speech challenged common assumptions, such as tapping into crypto liquidity or riding memecoin waves. Instead, it focused on what truly matters:

- Designing compliant products

- Creating investor-friendly solutions

- Ensuring usability that appeals to traditional financial audiences

This emphasis on practical, compliant, and user-centric RWA tokenization is precisely the point our expert, Michael Barskiy, was making.

S-PRO’s Voice at CAC 2025 Pre-Event

At the Pre-Event, Michael Barskiy shared what it really takes to bring real-world asset tokenization to life. With over 15 years of experience in fintech, traditional banking, and Web3, he brought a practical lens to a complex topic.

During his talk, Michael contrasted two eras of S-PRO’s asset tokenization journey – before collaborating with CoreLedger, versus the accelerated progress achieved afterward.

How We Developed Solutions Before

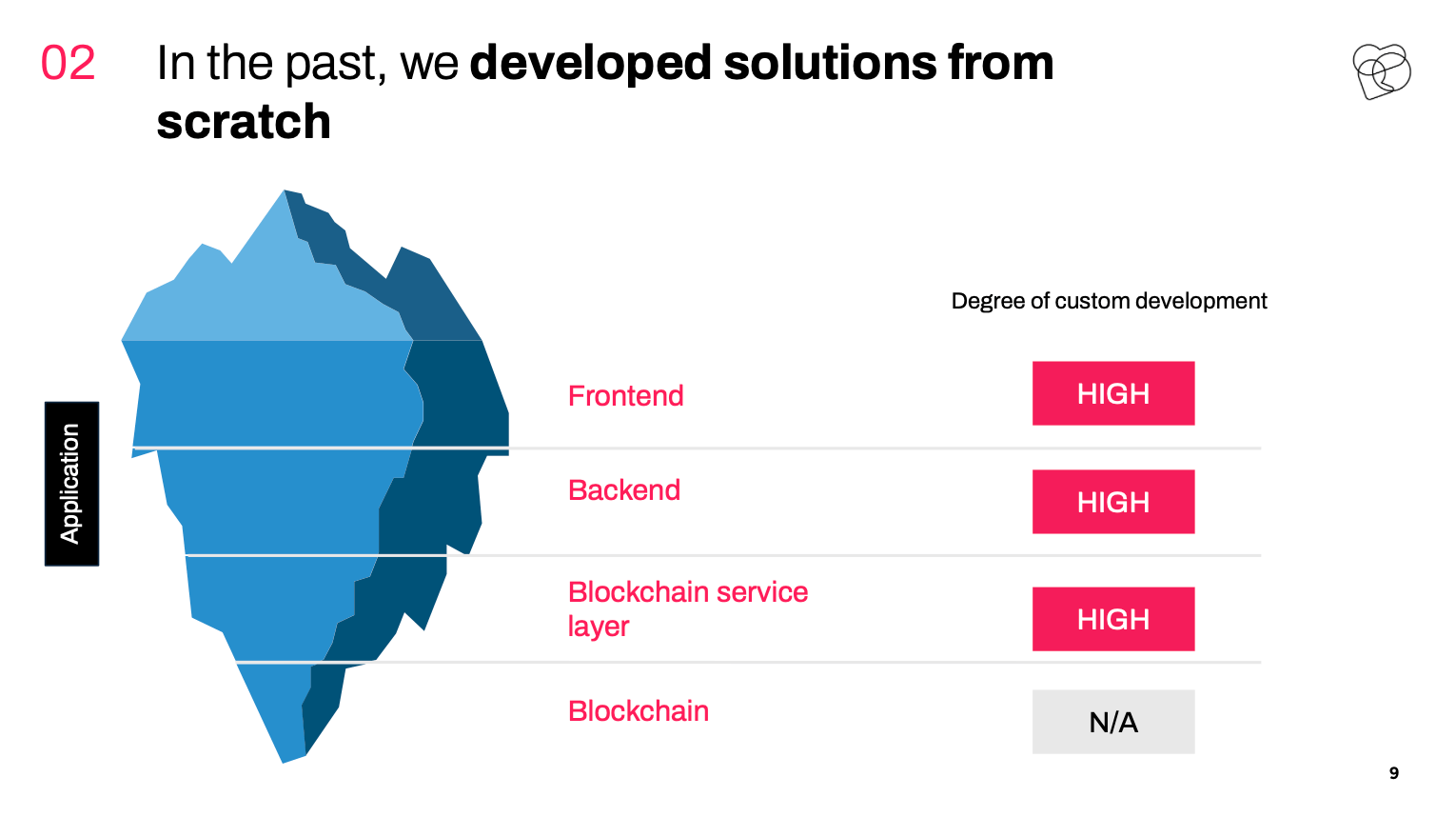

As Michael mentioned, S-PRO has been working in the digital finance and software space since 2014. Over the years, the company has helped financial institutions, digital asset banks, and fintech players build custom tokenization platforms from scratch.

While this approach offered extensive customization and flexibility, it came with a cost:

- A lot of funds

- A lot of time

- A lot of effort

When you come in, you’re really focused on the huge application. But you don’t realize how many complications are hidden under the hood. There’s a high degree of custom development involved. You’ve got issuers issuing the assets, admins managing them, the application layer itself – every part needs to be developed from scratch. That’s the iceberg we’re trying to tackle most of the time,

Michael Barskiy said.

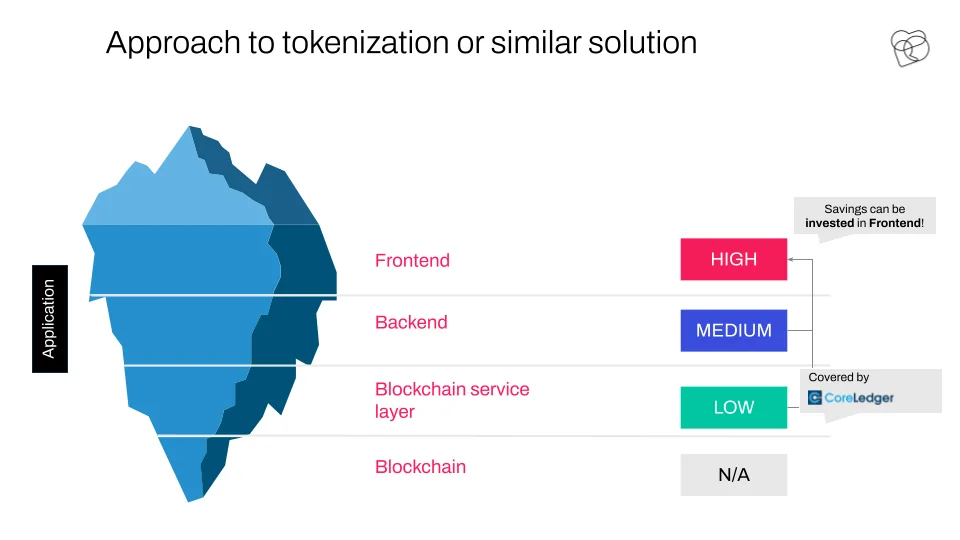

What Has Changed with CoreLedger

Basically, everything changed when S-PRO partnered with CoreLedger, a blockchain infrastructure provider. They solved the iceberg. S-PRO no longer needed to build everything from zero. CoreLedger’s API handled the heavy technical part.

Instead of spreading resources thin on under-the-hood aspects, this approach allowed businesses to focus on critical things, such as regulatory compliance, usability, and customer acquisition.

Michael also shared a recent case: a client aiming to tokenize real estate assets in the UK. Rather than reinventing the wheel, S-PRO and CoreLedger guided the client toward refining their tokenomics, whitepaper, and user journey – because the core tech was already in place.

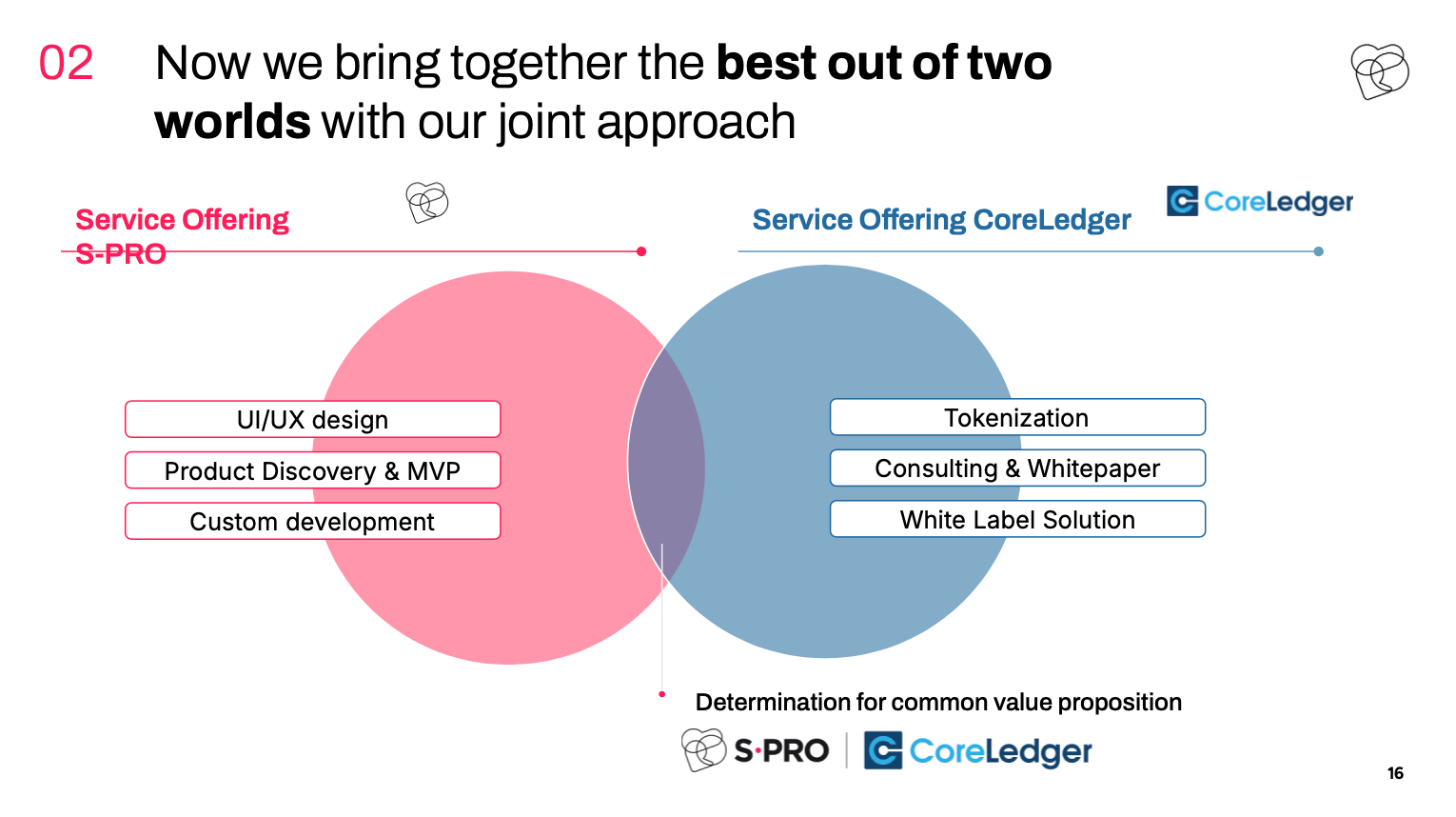

Now, the new approach S-PRO follows can be divided into two categories:

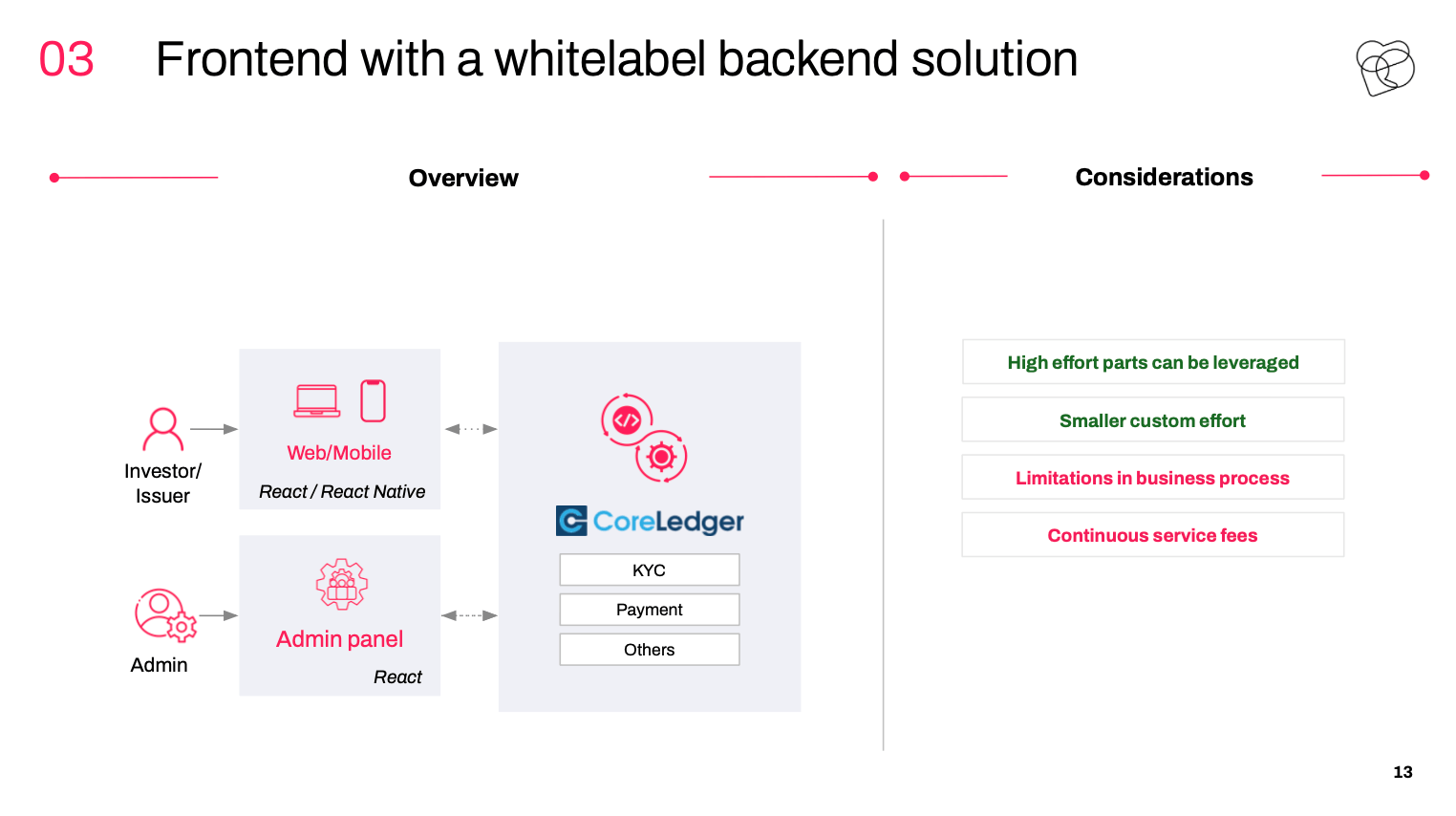

- Custom frontend + CoreLedger’s backend. This involves using CoreLedger’s whitelabel backend solution with S-PRO’s custom frontend for admins and investors (or what Michael likes to call the ‘sexy frontend’ approach). It’s fast, efficient, and gets you live quickly.

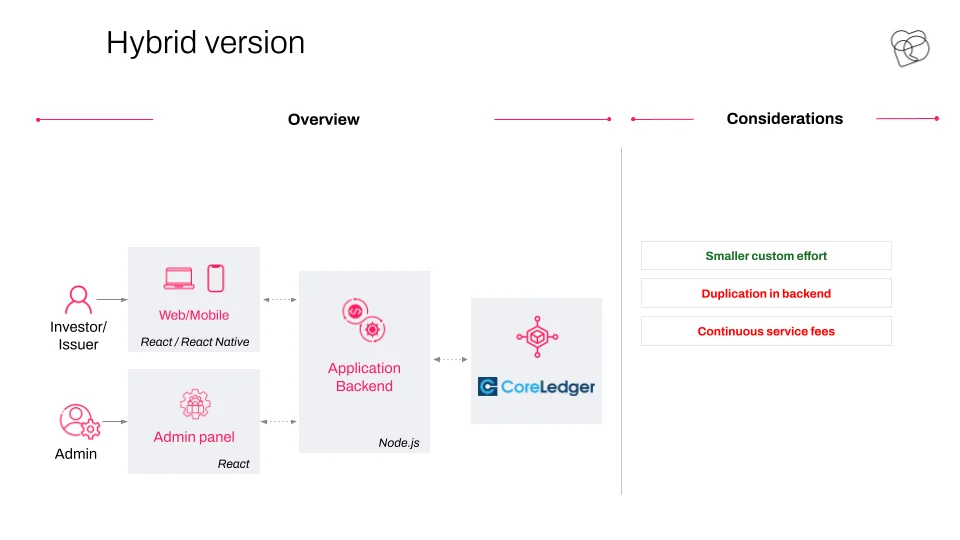

- Custom frontend + custom backend + CoreLedger’s infrastructure. This is a hybrid setup, where you keep more control over your application and databases, but still rely on CoreLedger for the core infrastructure.

In the end, you either find a way to work around the iceberg or you need to be bigger than it. That means deep pockets and serious resources. S-PRO’s goal is to help clients avoid that and go to market faster.

How We Work Together

Today, S-PRO and CoreLedger offer a streamlined path from idea to implementation. Michael outlined four pillars of the collaborative process:

- Consulting. Jointly defining scope and advising on tokenomics, focusing on end-customer value over nitty-gritty details.

- Discovery. Mapping out everything from user flows to regulatory requirements.

- Development. Moving to agile development, emphasizing intuitive UX and frictionless onboarding.

- Support. Implementing improvements iteratively as necessary.

All in all, offloading infrastructure to CoreLedger and bringing fintech, custom development, and design expertise, S-PRO lets clients launch faster, smarter, and with fewer unknowns.

Better Together: S-PRO and CoreLedger Partnership

We’ve mentioned our partnership with CoreLedger a few times, and it’s worth a closer look. This collaboration, active since February 2025, brilliantly combines complementary strengths:

- CoreLedger TEOS. Robust blockchain infrastructure offering everything from token issuance to compliance tools, both on-chain and off-chain.

- S-PRO. An expert development team that can deliver intuitive, scalable, and business-aligned applications.

What does that mean for your project? Throughout his presentation, Michael Barskiy kept coming back to one core thought:

When you have a partner who can really solve the technological complexity of your project, and you focus on your business idea and how your end customer will interact with it, that’s probably the biggest value you can have.

And what’s next for our partnership? We’re planning to jointly work on enterprise tokenization platforms, scalable industrial blockchain applications, and new models for making Web3 accessible to traditional businesses.

Final Thoughts

Mass adoption of Web3 won’t happen because of hype. It’ll happen because of simplicity. As Michael Barskiy put it, “If a regular investor finds it easy to register and use your platform, they’ll stay and have trust in it.”

And that’s exactly why RWA tokenization is such a hot topic right now. It’s all about making traditionally offline assets as easily accessible to real people as possible.

However, the reality is that building everything from scratch is the whole iceberg of heavy backend, frontend, and blockchain work. That’s what S-PRO and CoreLedger solve together: removing complexity so innovation can scale.