You can see fintech applications everywhere, from digital wallets, to budgeting apps, to online-only banks. The Software-as-a-Service tech model is at the forefront of digital innovation, and the impact it has on banking is growing – none more prevalent then the use of white label banking.

The global market of cloud-based Software-as-a-Service is projected to surpass 157 billion in 2020, and as of February 2021, there are now 10, 605 Financial Technology (Fintech) startups in the United States alone.

Financial services have experienced rapid advancement because of software services.

But the growth of Fintech has led to increased complexity for back-end users. Applications have eliminated legacy systems that use monolithic block structures, and traditional banks have now collaborated with tech giants to switch to microservice architecture. Migration to digital financial services is a costly and confusing task.

White label banking offers the perfect solution to the digital complexity and the speed to market now required by financial services. The singular banking platform:

- simplifies any digital systems

- enhances your customer’s experience

- and lowers the costs associated with traditional banking

We will discuss everything you need to know about white label banking – with the following information, you can decide on a white label solution that is right for you.

What is White Label Banking?

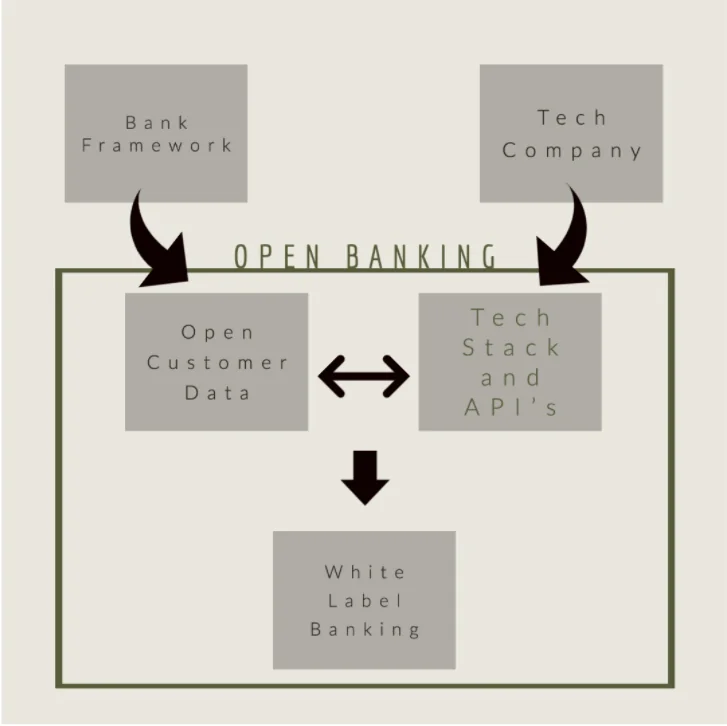

A White label bank is offered by a banking-as-a-service provider, where applications and API’s are built overtop of an existing bank framework and sold to new financial services.

It is much easier to take an old product and reuse it than to build your own.

That is what happens with white label banking:

- A financial service takes the existing bank infrastructure and repackages it with its personal brand.

- The startup takes the supplied finance structures and adds ontop any needed interfaces unique to its customers.

- The back-end system of the bank is already there; simply “whiteout” the product and put your own “label” on it.

You save all the time, effort, and expense of developing a brand new technology stack. Instead, use a premade, ready-to-use system and adjust it as required.

White label banking providers give you a pre-built system made from three core aspects:

1. The Existing Bank Framework

Traditional financial services have extensive software, compliance, and legacy systems designed to meet the demands of consumers and governments.

Yes, core banking services have experienced a rapid shift toward Saas and AI machine learning models, but the switch to large digital solutions is a massive undertaking. To save yourself all that extra effort, you can use the current frameworks other banks have already established.

This is the concept of open banking, where financial services allow third-party services to access customer data and digital solutions.

Instead of each bank holding an individual and centralized server, the industry now employs an integrated network that can share digital information.

The open banking system is flexible and agile to market conditions, especially as customers move further online. White label banking is the result of such open access to financial infrastructure.

2. BaaS Providers

Someone has to implement the digital systems of traditional banks, and various technology companies have developed the necessary software.

Known as Banking-as-a-Service providers, these software companies build and deliver the actual Application Program Interfaces (API’s) of financial institutions.

Through a BaaS provider, you can also select and receive the exact digital software you desire for your financial service.

There is no need to worry about build-outs or paying for extra software elements you do not want. Simply input the ready-to-use applications and present your consumers with a frictionless digital experience.

3. Your Brand

With the financial infrastructure provided by the bank, and with the application solutions maintained by the BaaS provider, all you need to do is label the product with your unique brand.

You can adjust each digital banking service to the requirements of your company and any customers.

Most Fintech applications allow you to:

- Open digital accounts

- Issue virtual cards

- Set up bill payment systems

- Give insurance quotes

- Offer digital deposits and withdrawals

- Apply for mortgages and loans online

Each service integration is capable of updating your client’s web page flow, and you can present branded graphics that improve customer loyalty towards your financial service.

Add in any company messaging, and change front-end marketing to make the application look like a brand new digital bank.

The Benefits of White Label Banking

Because of how easy it is to set up and open an entirely digital bank (also called a Neobank), white label banking has gained immense popularity.

There are a number of key advantages that white label banking provides:

1. Customer Experience

First and foremost, white label banks streamline the customer experience.

Open access to a wide range of services builds user engagement and brand trust. Consumer demand for digital experiences is at its highest, and offering the convenience of an all-digital bank meets that demand.

Additionally, digital applications can break down into interchangeable components. They are flexible. The agile nature of white label banking can adjust to rapid market changes and consumer desire – customization towards your clients will always increase revenues and ROI.

2. One-Size-Fits-All Service

With the distinct elements of the digital service set up for you by the BaaS, you eliminate any hassles involved with financial service infrastructure.

The most obvious benefit is the elimination of certification and license issues. White label banking removes the time-consuming task of government regulation.

Modern payment software systems are highly controlled, and you can skip the entire certification process through the financial framework borrowed from the existing bank.

Additionally, one-size-fits-all means you can initiate branding changes with ease. The singular platform you chose can morph to the whims of your customers, with each adjustment completed by your BaaS provider.

You receive maintenance and tech support as well, which can lower costly downtimes.

3. Cost Optimization

Best of all, cost savings are the primary advantage of white label banking.

A well-devised white label system gets you to the market faster. Skip the entire testing and build-out phase of any API’ integrations or stack creation. You can even save internal resources because you no longer need to hire full development teams or handle debugging.

Since your custom applications are supplied to you by a BaaS provider, you save on the disuse of physical real estate or servers. Your financial service can exist on cloud-based software, so there is no need for the expense of any physical assets.

| Customer Experience | One-Size-Fits-All Solution | Cost Optimization |

|---|---|---|

| Service Agility Selective Service Requirements Convenience Immediate Access Through A Laptop or Smartphone Personalized Banking Applications Customization Empowers Client Action |

Piggy Back On Pre-built Infrastructure Avoid Compliance and Regulatory Issues Create Brand and Image Alterations With Ease Simple Maintenance Service Flexibility |

Increased Speed To Market Componentization Less Reliance on Tech Support Access To Experts Cloud Based Server Hosting No Requirement For Physical Assets No Need For Internal Development Teams |

Legal Aspects of White Label Banking in the US

White-label banking arrangements must adhere to applicable banking regulations in the jurisdictions where the services are offered. In the United States, examples of such regulations are:

- Bank Secrecy Act. It requires banks to establish anti-money laundering compliance programs and report suspicious activity. White-label programs must comply with BSA requirements.

- Truth in Lending Act. It governs disclosures of credit terms and loan costs to consumers.

- Electronic Fund Transfer Act. It provides consumer protection for electronic payments, including debit cards and online banking.

- USA PATRIOT Act. It requires banks to establish Customer Identification Programs to verify customer identities and screen for prohibited entities.

- Consumer Financial Protection Bureau regulations. Those state that banks must comply with CFPB rules in areas like overdraft fees, credit card practices, and consumer privacy. White-label banking as a service must adhere to these rules.

The partner company shares responsibility for compliance. Banks conduct due diligence to ensure partners have adequate compliance procedures. Written agreements delineate each party’s regulatory duties.

In the US, white-label banking services are subject to oversight and regulation by several bodies:

- Federal Deposit Insurance Corporation (FDIC). It ensures bank deposits and examines banks for safety and soundness. FDIC regulates the banks providing white-label services.

- Office of the Comptroller of the Currency (OCC). As the primary regulator for national banks, the OCC oversees any national banks engaged in white-label banking activities.

- Federal Reserve. It regulates bank holding companies involved in white-label programs. It also oversees payment systems used for banking services.

- Consumer Financial Protection Bureau (CFPB). It enforces consumer protection laws and regulates consumer financial products, including those offered via white-label programs.

- Financial Crimes Enforcement Network (FinCEN). This organization enforces laws and regulations related to anti-money laundering and the Bank Secrecy Act as they apply to white-label banking services.

- State banking regulators. Those regulate state-chartered banks participating in white labeling. States establish banking laws banks must follow.

While the partner company does not face direct oversight, bank regulators review white-label programs for regulatory compliance as part of routine bank examinations. The partner company may also be subject to indirect oversight via agreements with the bank.

White Label Banking Selection Criteria

While white label banking offers many solutions to the digital complexity of financial services, there are some challenges that you should be aware of before you sign with the nearest white label provider.

With the explosive growth of fintechs and BaaS options, the software quality can range from good to bad.

Plus, if you want a highly personalized brand messaging installed onto the white label banking system you purchased, you may still need a developer to help with additional service requests.

The further you move away from the standard functionality offered by the white label provider, the more complex and expensive your digital solution becomes.

You can decide on the middle ground between fast and cheap VS custom and expensive.

To help you decide on the best white label provider, ask yourself these questions:

1) Does the White Label Provider have all the necessary licences and regulatory certifications across all the different countries and regions my customers are based in?

Compliance and governmental law change between different geographic regions.

Selecting a U.S. provider who does not have GDPR compliance in the U.K. will cut off any access to your European customers.

Make sure they are also PSD2 compliant so you can operate a payment system across Europe.

2) Does the White Label Provider offer advanced security?

With the rise of cloud-based hosting, bad actors have employed credential stuffing or bot attacks to access financial data.

Make sure you get a complete understanding of the security measures your white label provider maintains.

3) What is the maturity level of the white label providers software development?

If you need advanced services that can meet the needs of your client, be sure to find a provider that will specialize its products.

The more integrations you can have with other innovative digital offerings, the more value-added. Comprehensive integration chains add more complexity, so make sure it gives you a positive return on investment.

How to Choose the Right White Label Banking Providers

Selecting the appropriate white-label provider that matches your operational style can be challenging, whether it involves a novel financial software or an internet-based retail store.

Factors to Pay Attention to When Choosing a Provider

The main factors are expenses, how communication is managed, the ability to deliver, existing customers, collaborations, and instances that demonstrate success.

Your provider should be compliant with all relevant regulations and have robust security practices, including encryption, fraud monitoring, and data protection. Look for modern APIs and integration options to connect the white-label bank to your other systems. Make sure they have the capacity to process the number of transactions you anticipate and can expand as your needs grow.

You should look for ample branding and personalization options to tailor the look and feel of the banking platform to your brand. Robust reporting and analytics will also give you insights into customer behavior and banking operations. Ensure your provider offers advanced analytics capabilities.

Comparing and Evaluating Different White Label Banking Providers

When researching options, develop a core list of must-have features based on your priorities. Shortlist providers that meet your technical and functional needs, then compare offerings in detail. Here are some examples for comparison:

- Pricing models. Compare setup costs, monthly fees, and transaction fees across providers. Watch for hidden costs.

- Contract terms and SLA commitments. Review contract length, termination policies, and service level agreements.

- Onboarding/implementation timeline. The right provider will have a quick yet robust onboarding process to get your banking services up and running.

- Ongoing support model. Assess the provider’s support channels and resources. Look for dedicated reps and transparent escalation policies.

- User reviews and reputation. Check third-party reviews and testimonials to evaluate customer satisfaction levels.

The checklist of standards will assist you in evaluating various providers and discovering the most suitable option for your business.

SaaS Versus On-premises White-Label Banking

SaaS options require less upfront investment but less control. On-premises gives you more customization power but requires more implementation effort. Assess your budget, control needs and IT resources to decide between these models.

Negotiating the Terms of the White-Label Banking Partnership

During contract negotiations, ensure you bargain for the best possible terms for your business. Focus negotiations on:

- Customization options. Negotiate for expanded branding and tailoring options for your platform.

- Revenue sharing. Structure an appealing revenue share model between you and the provider for customer fees.

- Contract flexibility. Push for shorter terms, flexible renewal options, and appropriate termination policies.

- SLAs and support. Demand rigorous SLAs for uptime, technical issues, and support response times.

- Pricing. Negotiate firmly on pricing and work to minimize monthly/transactional fees.

With due diligence and careful provider evaluation, you can find the right partnership options for your white-label banking as a service to power your business’s financial services and support your growth.

Case Studies: Successful White Label Banking Implementations

White-label banking solutions have become an increasingly popular way for e-commerce platforms to expand their payment options and reach new markets. Here are three examples of successful implementations:

Stripe and Shopify

Using Stripe, Shopify made over 4 billion dollars in Canada in a year. Stripe’s white-label payment processing allowed Shopify to provide a seamless checkout experience to customers while handling the complexity of payment processing in the background.

When Shopify integrated Stripe as a payment option, it gave Shopify merchants access to hundreds of local payment methods in over 135 currencies. Shopify empowered millions of small businesses to accept credit card payments online by integrating Stripe as a payment processor.

PayPal and Magento

Another e-commerce platform, Magento, partnered with PayPal to provide an embedded payment solution called PayPal Payments Pro. According to Magento’s data, merchants using PayPal Payments Pro through Magento saw increased sales volumes worldwide.

PayPal’s wide brand recognition provided a trustworthy payment option that could boost conversion rates. Statistics show that consumers are 28% more likely to have a positive purchase experience purchasing with PayPal.

Adyen and eBay

When eBay sought to expand globally, it turned to Adyen for localized payment methods. Adyen’s white-label payment platform allowed eBay to accept various payment types from customers worldwide without having to build its own payment infrastructure. It included offering popular local payment options with a seamless eBay-branded checkout.

By leveraging white-label banking as a service, companies can provide a seamless customer experience without the complexity of building banking infrastructure from scratch.

The Bottom-Line Of White Label Banking

In the past, people managed their money at a physical bank branch.

Now, Fintechs have taken the vertical integration of the digital open banking space and revolutionized personal finances. Startups continue to offer new software solutions that give clients more command over their money, all within a convenient application.

As traditional institutions attempt to catch up to the speed of financial technology, White Label banking will become the basis of financial services.

Companies that take advantage of the speed to market and overall agility that white label banking offers will take a major foothold over slower legacy systems.

If you need more details regarding white label banking, S-PRO can help you discover a wide range of digital solutions and White Label API’s.

Remove the hassle of brand differentiation strategies, and eliminate development costs associated with selecting a BaaS provider.