Drive high-value financial strategy with our SaaS asset management system. Optimize lifecycle tracking, investment oversight, risk monitoring, returns, and compliance.

Move beyond outdated approaches to a platform that empowers financial success.

Drive high-value financial strategy with our SaaS asset management system. Optimize lifecycle tracking, investment oversight, risk monitoring, returns, and compliance.

Move beyond outdated approaches to a platform that empowers financial success.

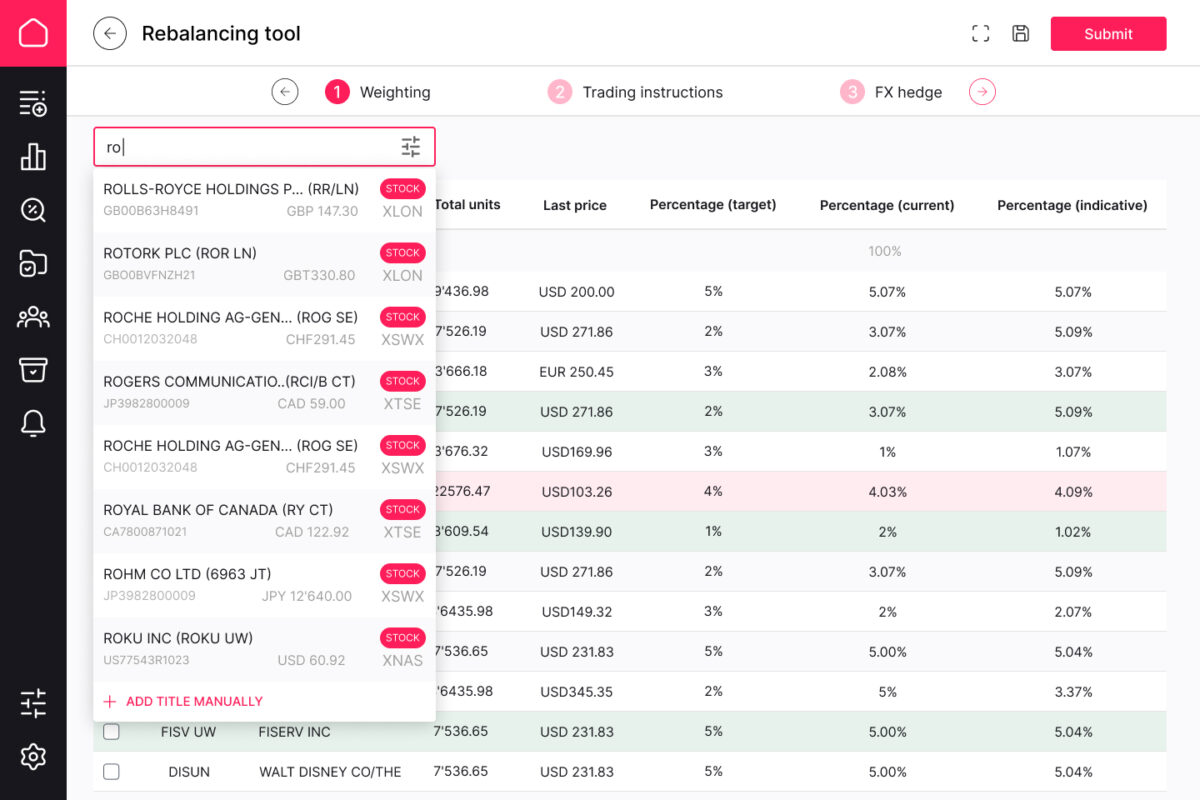

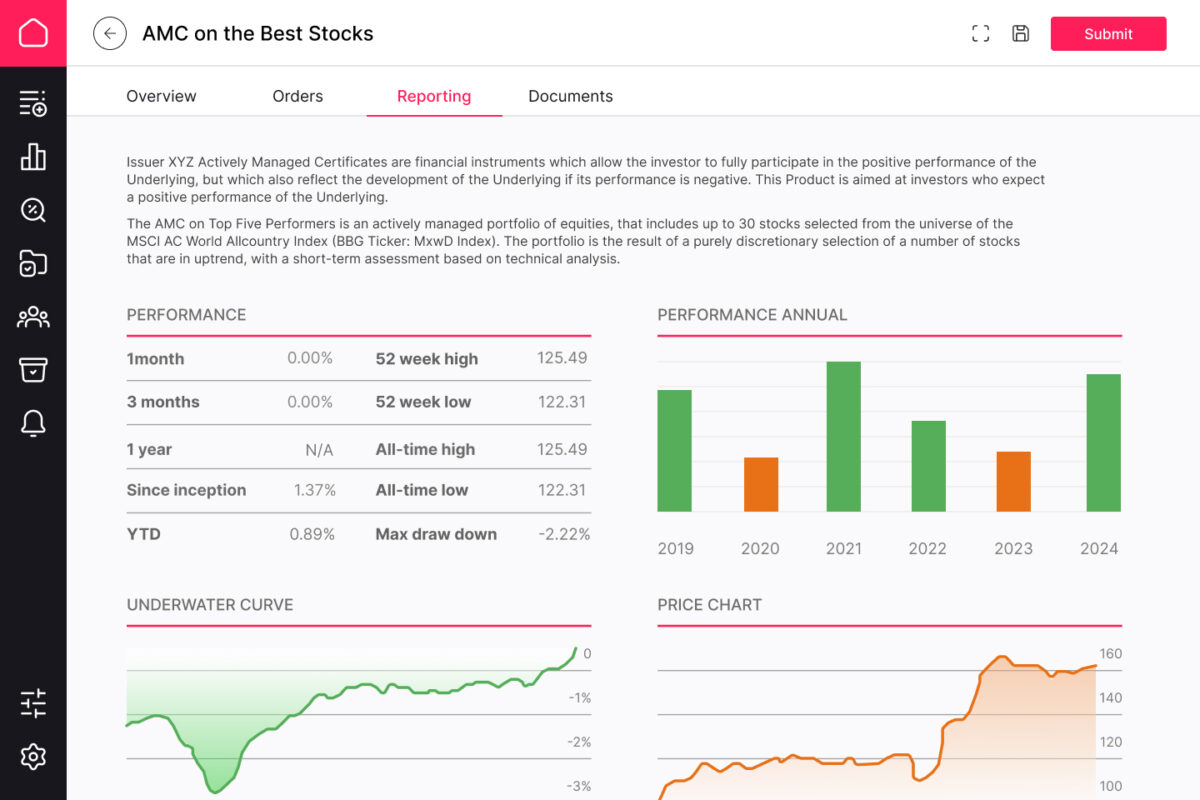

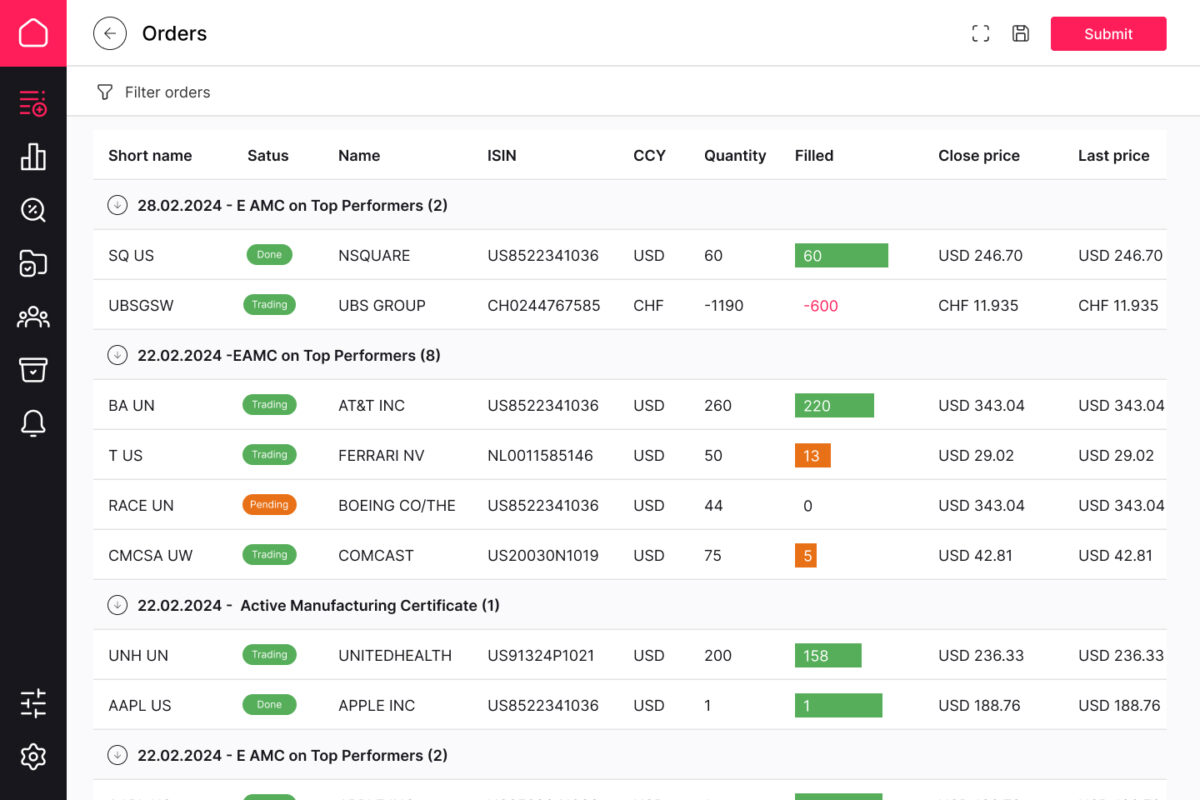

Actively Managed Certificates (AMCs) are structured investment solutions that combine professional portfolio management with the transparency and liquidity of exchange-traded securities. They offer a flexible approach to managing diversified assets, from equities to alternative investments, in a cloud-based asset management application.

Exchange-Traded Notes (ETNs) are debt-based instruments issued by financial institutions that track the performance of specific assets or indexes without direct ownership. This asset management solution provides exposure to diverse markets and includes a robust, cloud-based database to support secure, efficient asset tracking.

Separately Managed Accounts (SMAs) provide a customized investment approach, offering direct ownership of individual securities. Our cloud-based solution streamlines the management of SMAs, allowing asset managers to meet the unique needs of clients through detailed asset tracking and efficient portfolio management.

Actively Managed ETFs are investment vehicles where fund managers actively adjust portfolio holdings to maximize returns. Our asset management application enables dynamic asset tracking and supports these ETFs with a secure, cloud-based database, ensuring adaptability in response to market trends.

Limited Qualified Investor Funds (L-QIFs) are designed for qualified investors seeking access to exclusive asset classes. Our cloud-based asset management solution supports L-QIFs with extensive asset tracking and inventory management, ensuring efficient handling of diverse portfolios.

Institutions must navigate a complex web of local and international regulations (e.g., MiFID II, PRIIPs, UCITS) that govern the issuance, management, and distribution of structured products. A cloud-based solution can improve regulatory compliance and adherence to standards.

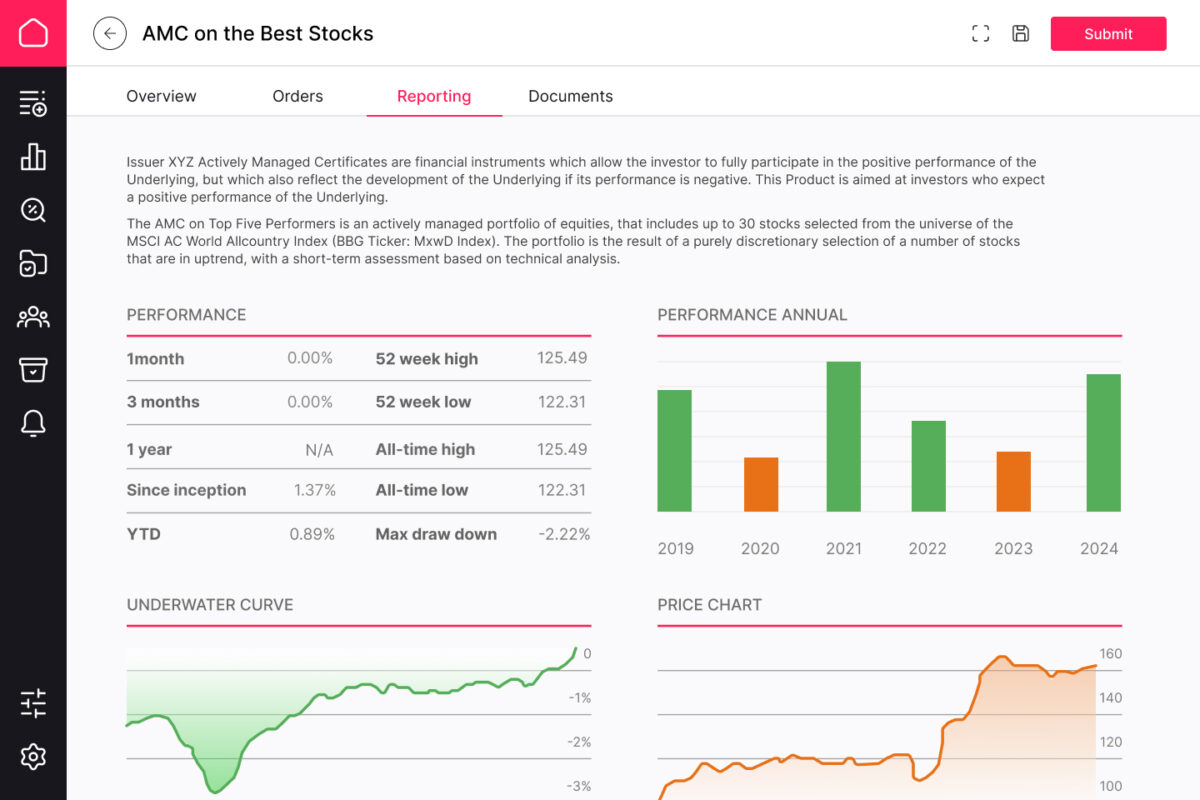

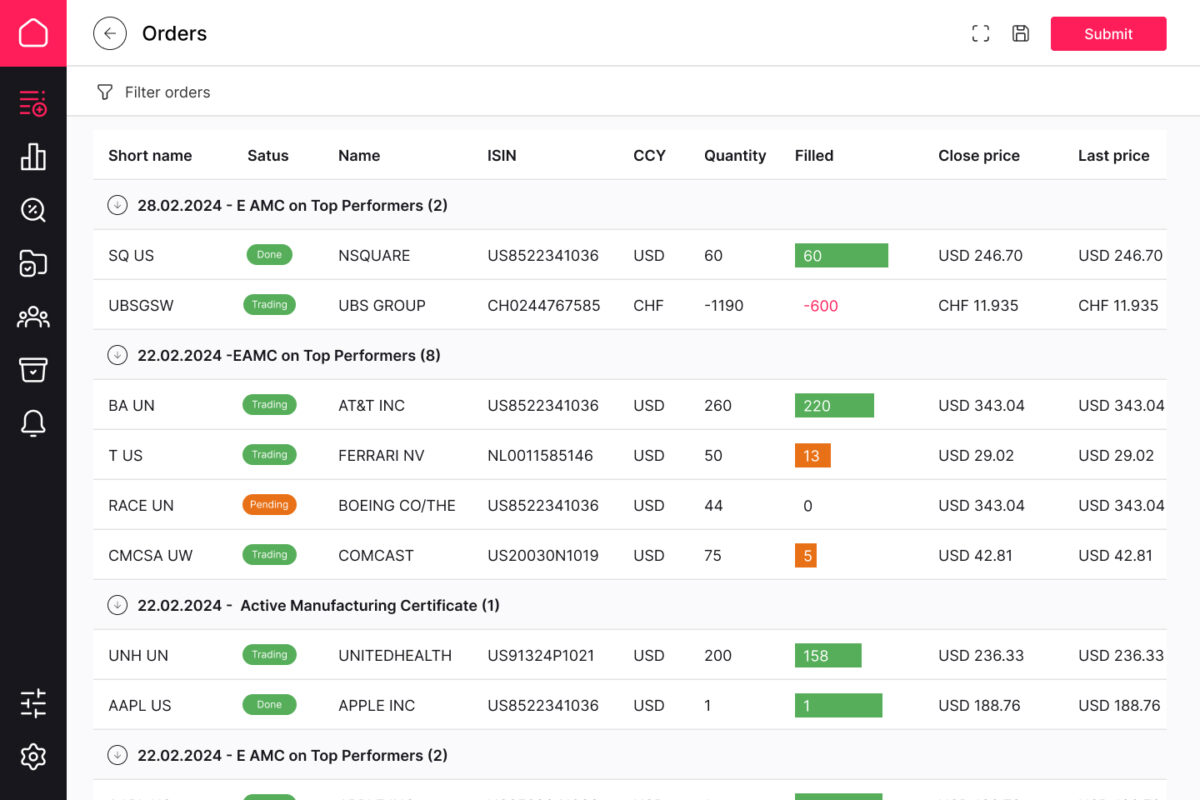

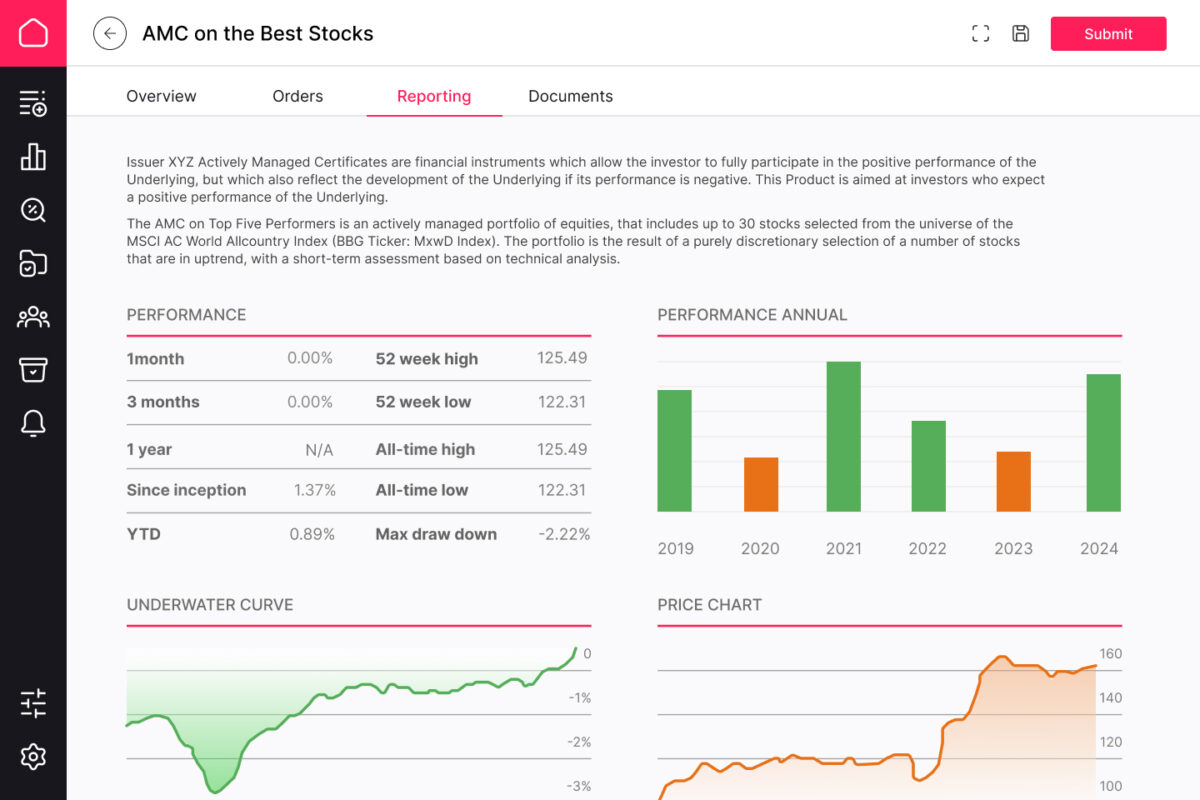

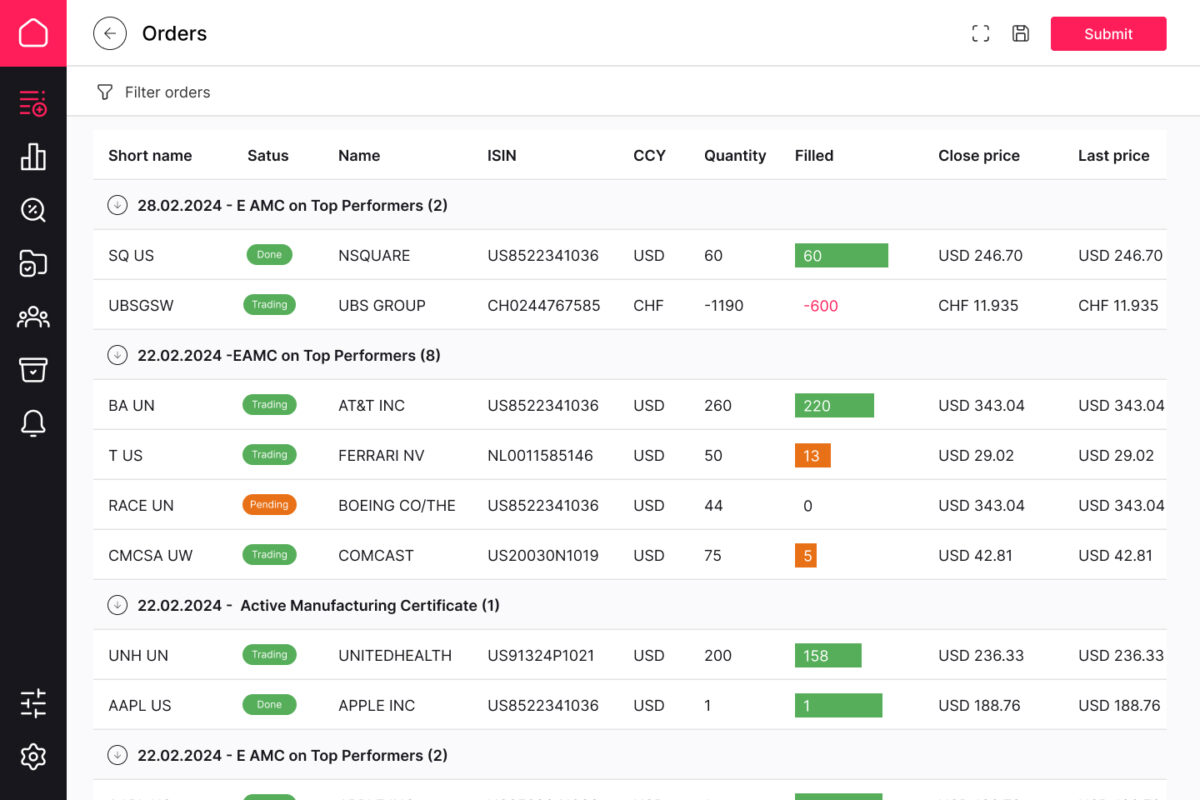

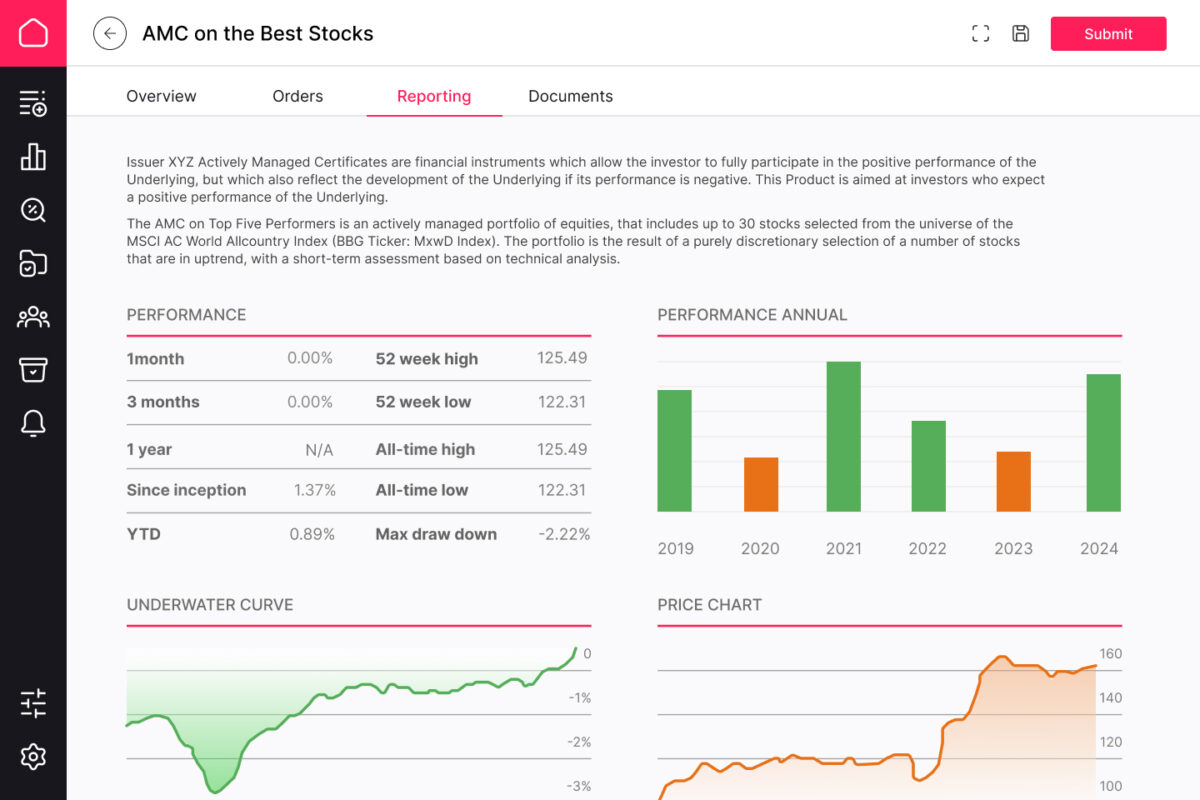

Reporting for AMCs involves generating detailed performance, risk, and compliance reports tailored to different stakeholders (e.g., clients, regulators, internal teams). The reports need to comply with standards like IFRS, Basel III, and local tax regulations and depend on types of assets (e.g bankable, non-bankable Assets) within the asset management framework.

Institutions frequently operate on core-banking IT systems that lack the capability to handle the dynamic needs of AMCs, especially when dealing with complex asset structures or multi-asset class strategies. Integrating a comprehensive application can bridge the gap between specific functionalities required for efficient AMC management.

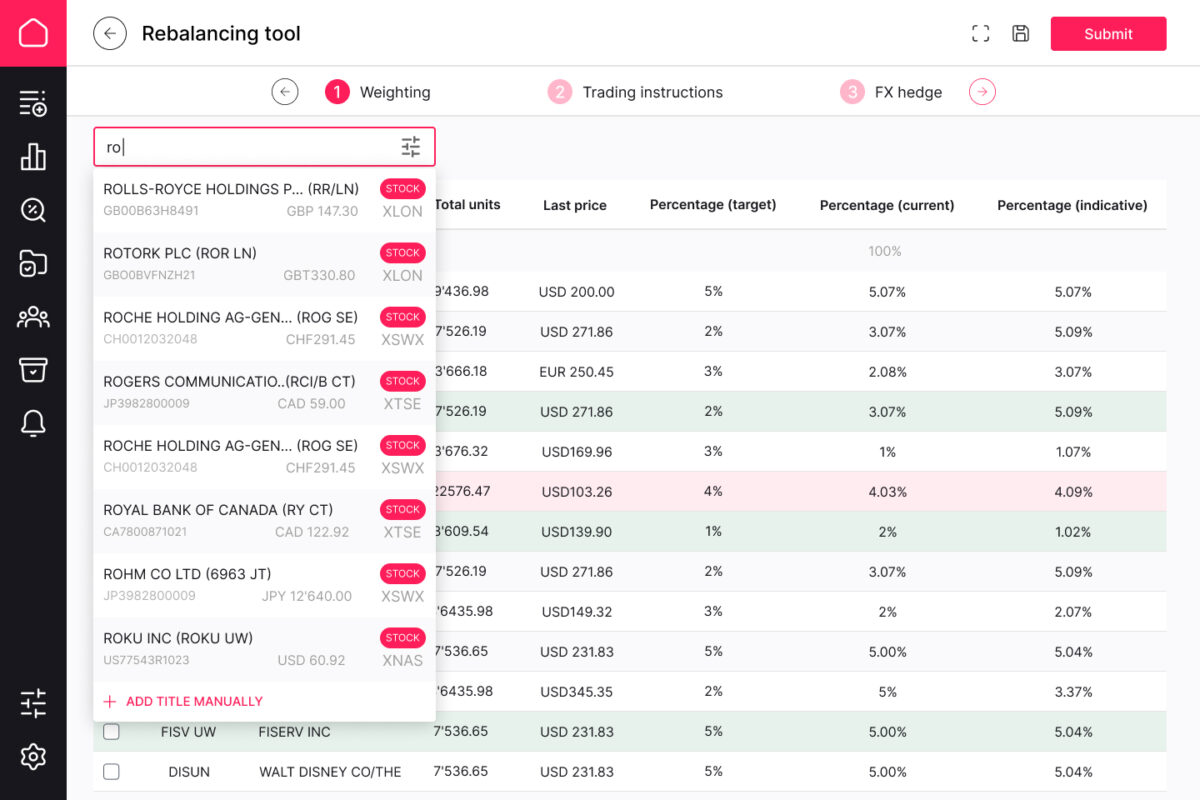

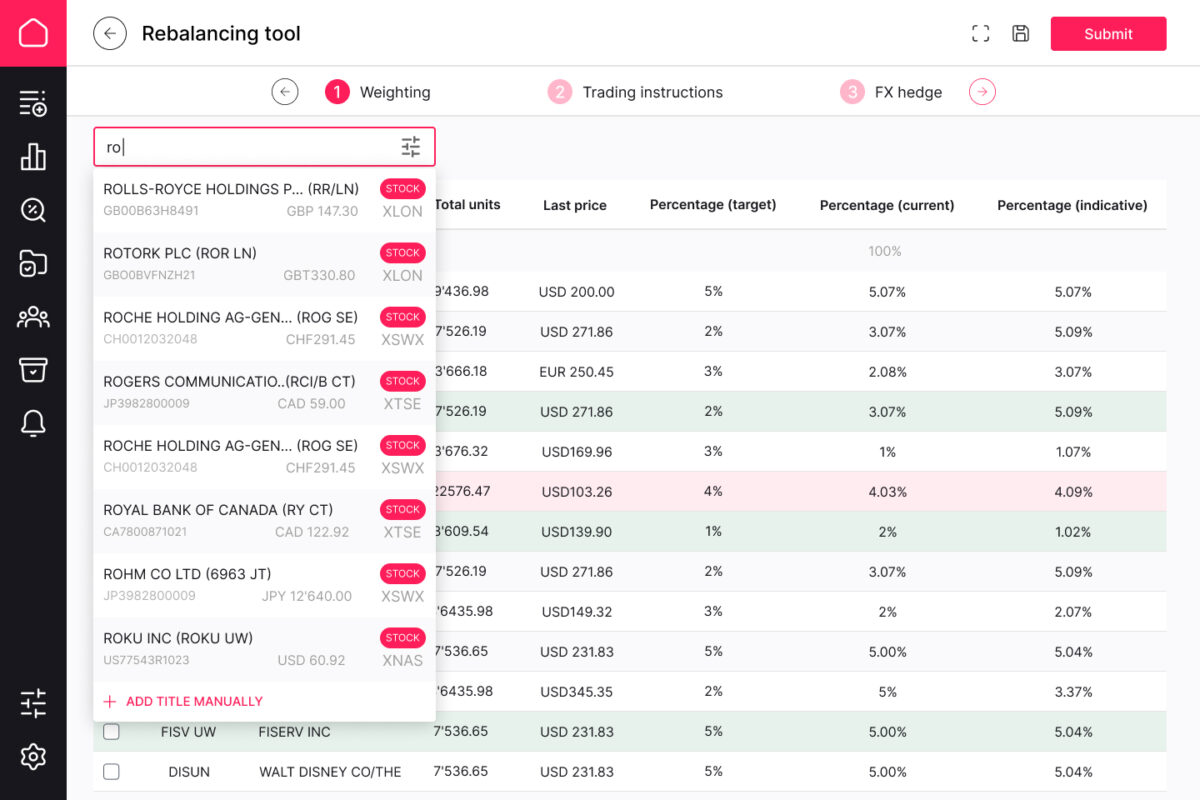

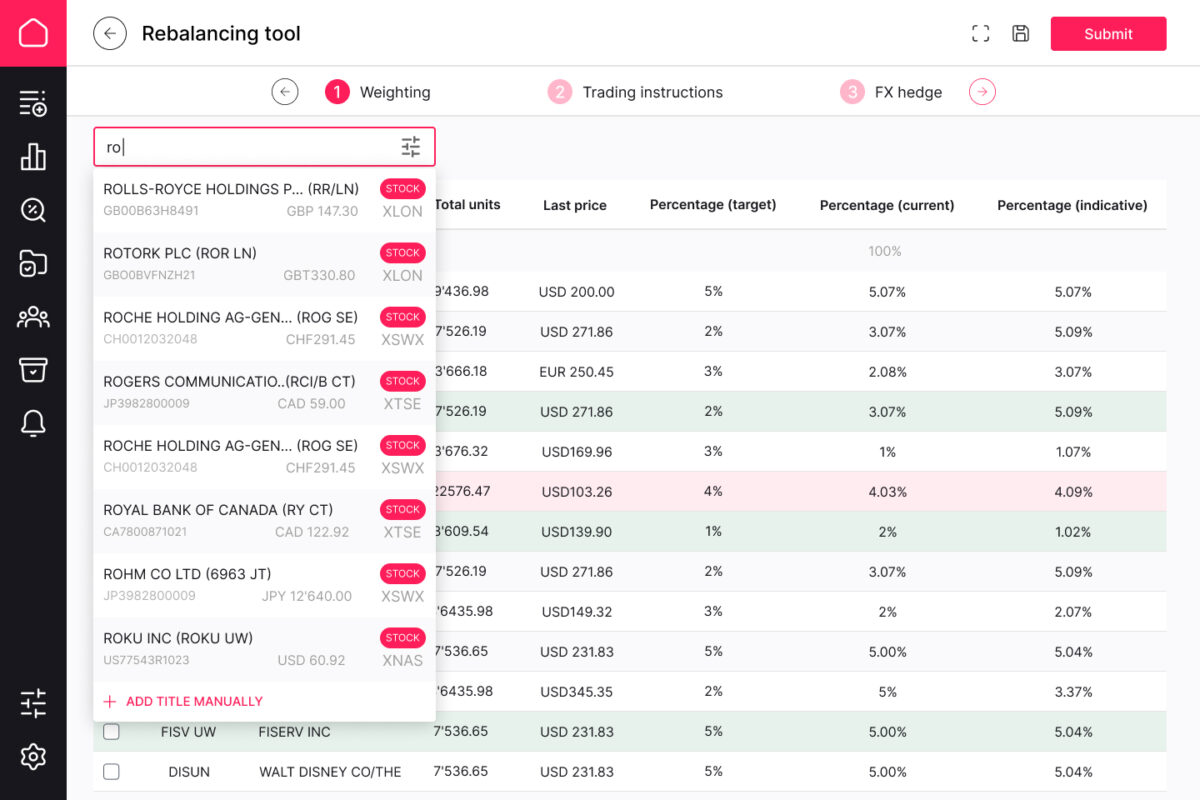

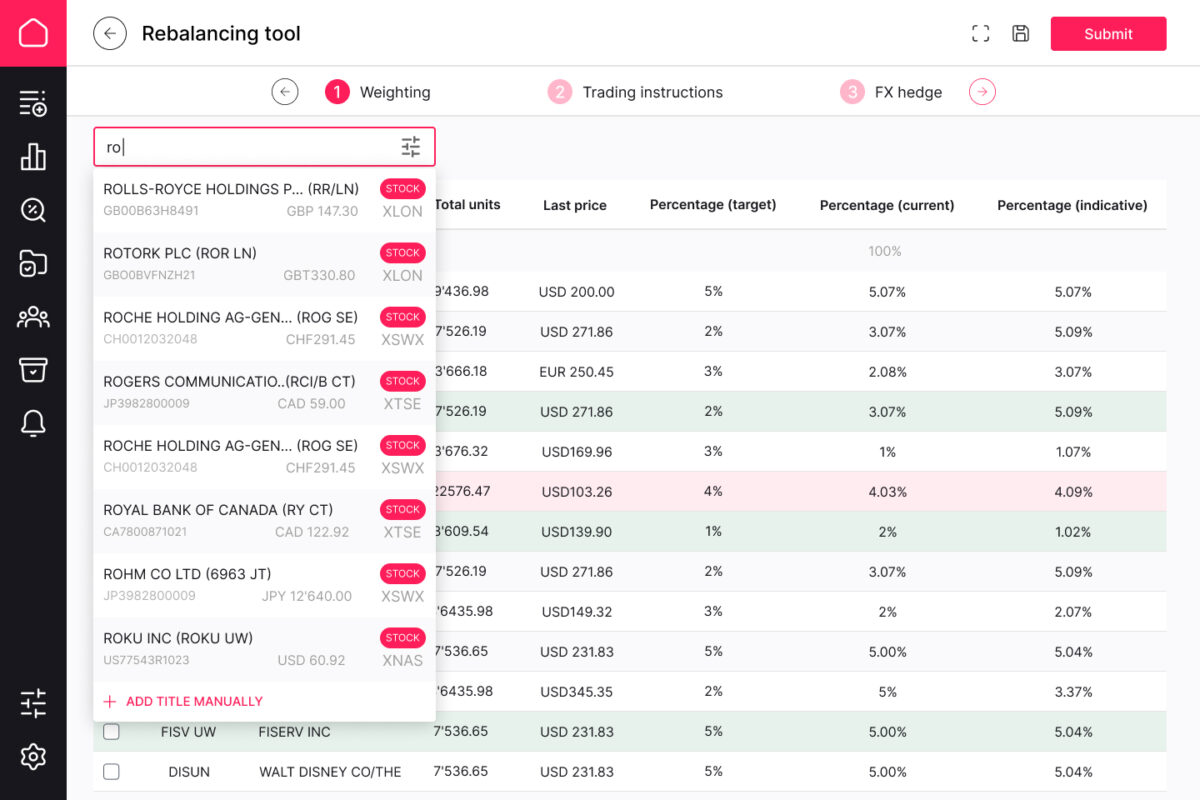

AMCs require real-time market data, pricing information, risk metrics, and performance analytics from multiple sources. Integrating these heterogeneous data feeds (e.g., Bloomberg, Reuters, in-house databases) into a single coherent system is challenging.

Ensuring robust protection for sensitive client and financial data while managing complex IT infrastructure is a critical challenge. Implementing advanced asset tracking and real-time monitoring safeguards your inventory of sensitive information, securing client trust.

Senior Business Analyst

Areas of expertise: finance strategy and transformation, specializing in driving financial growth through strategic planning and operational improvements. Proficient in business analysis, controlling, and reporting.

Head of S-PRO Switzerland

Areas of expertise: IT, banking, corporate finance, and digital onboarding, with a strong focus on business development and management.

We’ve developed a solution that lets us add functionality specifically tailored to your unique asset management needs. We can also create custom workflows aligned with your business requirements.

With S-PRO asset management platform, you only pay for the features you need. Our pre-built, cost-effective solution is faster to implement, and we provide business analysis to ensure the platform is aligned with your business goals – no unnecessary features or costs.

We begin with an introductory call, followed by a design thinking session, business analysis, and a feasibility study to ensure the solution is practical and optimal.