The wealth industry is in the middle of considerable changes. The COVID-19 crisis has collapsed the whole industry. Companies are now embracing the latest technological solutions to fulfill the expectations of a new generation of investors. We will see asset firms to utilize mobile apps, Big Data, AI, and more. In this article, we uncover the accelerating trends in wealth management (WM) to revamp your business.

#1 Post-COVID continuity plans

Even before the COVID-19 crisis, online wealth management platforms started to intensify fees and raise concerns regarding social and governance factors. The COVID-19 outbreak has posed many challenges. COVID-19 CFO Pulse Survey informs us that finance leaders in the United States are mostly worried about the financial impact.

The price for publicly traded assets has dropped by 20 percent since February. A vast area of fixed income markets, including corporate credit, are under stress. Such markets as Mergers and acquisitions (M&A) and Initial public offering (IPO) may limit their activities until stabilization.

The majority of wealth businesses are already implementing continuity plans. They’re applying various technologies to mitigate the financial impact and pull in more clients to their services. These plans are still not substantial enough to cover all the variables. Companies need to consider breaking points, third-party risks, and more.

In the risky times, advance measures become ‘new normal’, so WM companies should better offer their investor clients access to multiple channels and advisory models simultaneously, and provide downside protection and hedging more than diversification. Also, advanced analytics is a must for tracking core processes.

#2 Automation

The financial sector is still hanging back when it comes to technologies. Celent names automation as a deciding factor on who will win the asset market. Over forty-five percent of wealth businesses are only partly satisfied with their current digital solutions.

Automated wealth management streamlines workflows and day-to-day administrative duties and minimizes potential risks. So businesses can spend more resources on client service and prospecting.

Eighty-six percent of companies view serving clients as a vital digital capability. Advisors need access to rich data and analytics to deliver personalized services. Automation will help managers decide on investments rapidly and effectively and even make bulk trades where necessary. That is, companies can manage numerous assets more cheaply.

#3 Mobile Apps

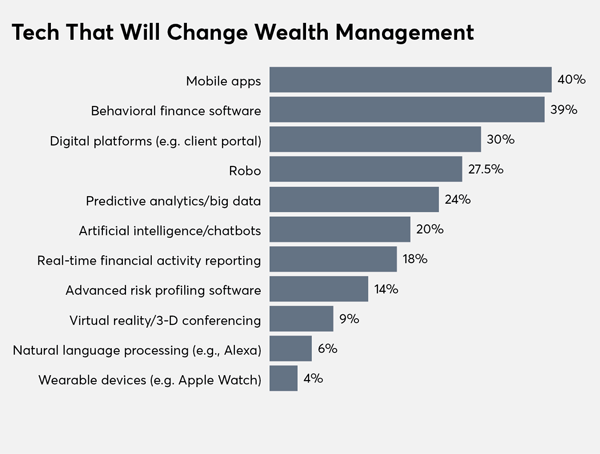

Mobile technologies are another lucrative investment for WM firms. Financial Planning survey states that 40 percent of wealth advisors think mobile apps will transform the industry.

Source: Tech Survey by Financial Planning

Mobile apps provide advisors with a unified front-end to tap into multiple information flows and access the latest data. Using mobile apps, wealth managers can also perform analyses, run reports, place buying, and selling orders. Mobile technologies allow advisors to address client’s needs immediately.

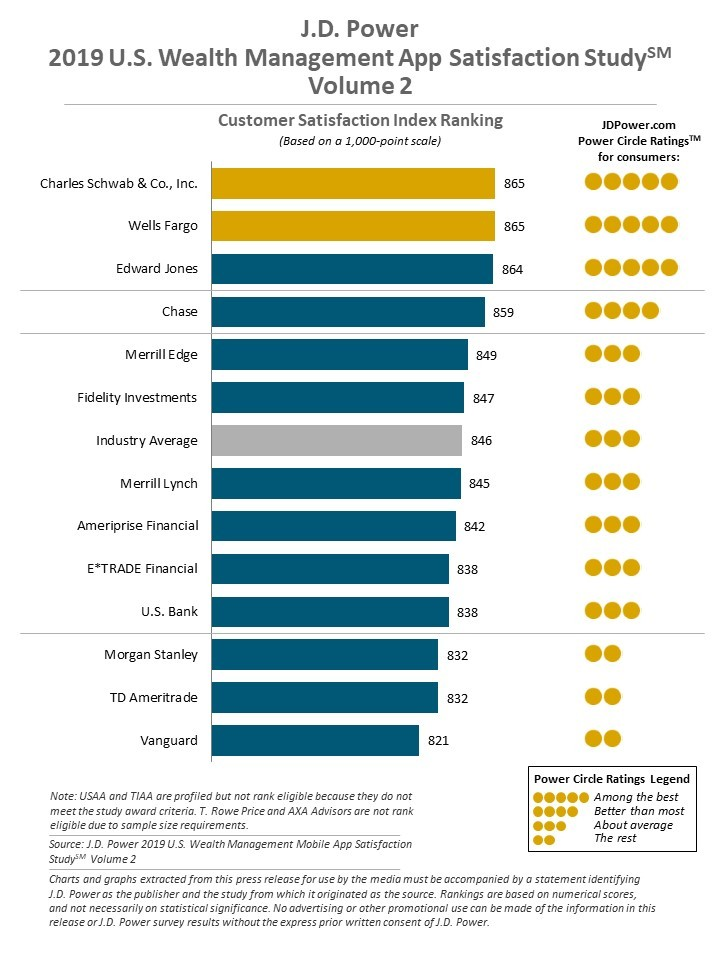

Michael Foy, Senior Director of Wealth & Lending Intelligence at J.D. Power, says that the mobile experience is “a critical factor” that can convince investors to try new products and services. There is a huge gap between customer satisfaction with wealth mobile apps and apps for other financial services. Wealth apps got only 846 out of a possible 1,000 points.

Source: J.D. Power 2019 U.S. Wealth Management Mobile App Satisfaction Study Volume 2

With stiff competition, wealth firms should find a reliable technical partner to deliver an exceptional mobile experience. S-PRO knows the WM industry from the inside and can help to form and test different hypotheses to build a product that wins its place and demand on the market. You can also use a synergy of our partnerships to get support in the matters of finances, marketing, and technologies.

#4 Cybersecurity

The last year showed the vulnerability of the financial sector. The financial industry is determined as a third top affected sector by cyber attacks. Phishing (forty-two percent) and man-in-the-middle attacks (thirty-six percent) expose the most danger for WM companies.

The safety of client sensitive information is the most critical asset in the investment business. This is why the best wealth management platforms integrate efficient tools to detect and prevent attacks. It’s essential to safeguard your software on multiple levels ‒ email, social media, messaging platforms, and more. For instance, JP Morgan spends $600 million on security annually.

To get more Fintech insights, read Fintech Security and Compliance best practices.

#5 Artificial intelligence will change wealth management technology trends

AI is one of the rapidly growing trends in wealth management software. Clients demand personalized offerings from their WM firms. Fifty-six percent of High-Net-Worth (HNW) clients aren’t satisfied with relationships with their wealth advisors. The main reason for clients’ frustration is a lack of emotional intelligence. Clients also complain about insufficient face time and value-added services.

Artificial intelligence can help managers provide highly-personalized services at scale. AI helps boost advisors’ productivity and lower costs since managers don’t need to spend ages on deriving insights manually.

AI-based wealth products provide rich data and analyze market sentiments to deliver custom and accurate advice to the client. Thus, MarketPsych analyzes various blogs and new posts on the internet to evaluate the market perception for a particular investable product. With tailored and customized offerings, wealth management advisories (WMA) can pull in more clients and strengthen the relationships with the existing ones.

#6 Robo–advisors discover online wealth management platform

Deloitte predicts that robo-advisers will be managing $16 trillion of assets by 2025. In comparison, BlackRock ‒ one of the biggest asset managers today — manages three times fewer assets. Robo-advisory uses mathematical algorithms to support investment decisions. Robotic advisors highlight Exchange Traded Funds (ETFs), risk appetite, and liquidity factors to streamline burdensome client onboarding and deliver a more exceptional customer experience.

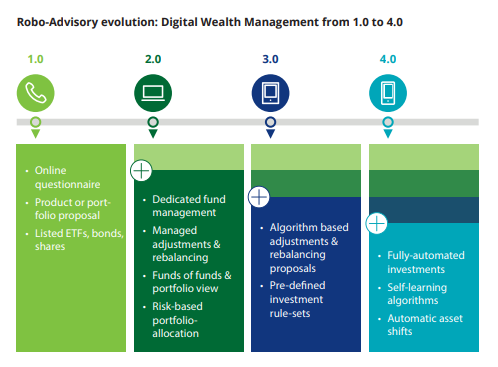

Robo advisory has been evolving mainly for the last five years. The first generation of robo-advisors perform online questionnaires and provide clients with a single product proposal. Clients are in charge of buying and managing their real portfolios. Betterment is one of the pioneers in the robo-advising class that has been evolving with time.

The second generation offered semi-automatic services with portfolios created as a fund of funds. The dedicated manager is responsible for portfolio allocation and adjusting.

In the third generation, the special algorithm that determines when to rebalance a portfolio or make an investment. This algorithm works on predefined investment strategies. The professional fund manager makes the final oversight.

Source: The Expansion of Robo-advisory in Wealth Management by Deloitte

The fourth-generation offers fully-automated investments. There is an AI-powered self-learning algorithm that supports automatic asset shifts.

#7 Big data

Financial analytics consider big data as one of the most promising wealth management software trends. High-quality massive data can help WMA firms grow their business globally and maximize sales. Big data brings wealth managers new ways to engage with new clients, manage relationships with existing ones, and reduce risks.

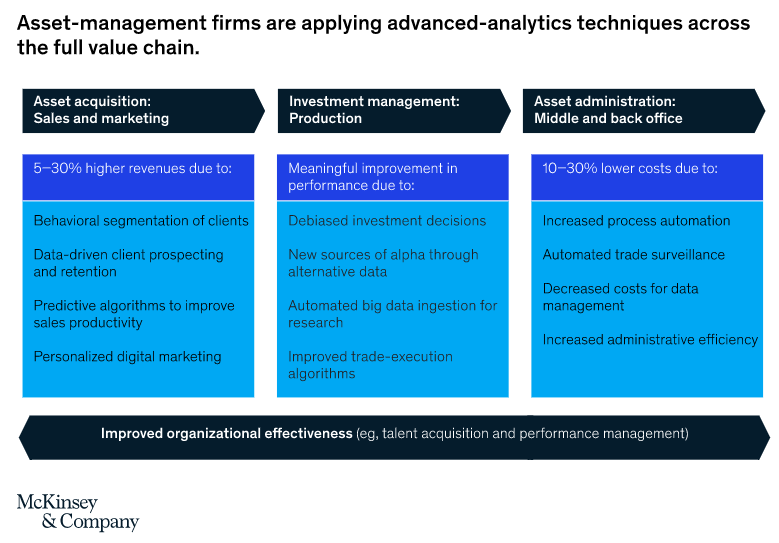

Big data can optimize each point of the asset-management value chain — from asset acquisition to asset administration. Advanced data helps managers to tackle specific business problems not by replacing humans but by enabling them to make decisions swiftly and consistently. Big data helps WM firms evaluate the needs of their clients and offer more informed financial advice.

Source: Advanced analytics in asset management by McKinsey & Company

Big data also provides necessary insights to optimize distribution and improve investment performance. Companies can use Big data to raise productivity in the middle and back offices as well.

Trendsetting

Wealth management companies are focusing on providing personalized services via technologies. The demand for AI-powered solutions, big data, and mobile apps will rise in the coming years. These technologies help wealth managers build a stronger relationship with customers, provide value-added services, and increase productivity. High-Net-Worth clients aren’t satisfied with most of the current technological solutions provided by their WM companies. So there is still room for improvement.

If you need any assistance with implementing technologies into your wealth management startup, contact our experts. As a tech partner, S-PRO provides a full package of fintech development services. We bring our clients products from a business roadmap to a market-ready product. Our experts have years of proven experience in developing fintech software. We entered into a partnership with companies in analytics, regulatory, and blockchain to help you overcome development challenges.